If you only read one section, read this. Here is what matters in this study.

The U.S. Hispanic population is the entire CPG team.

While non-Hispanic household unit sales are dipping (-0.3%), Hispanic households are up +1.7%.

➡️They are the only ones actually buying more.

Awareness on Guava is high (74%), but it’s mostly floating around in beverages.

➡️There is a massive gap for guava in packaged bakery and desserts.

Dulce de Leche is officially mainstream.

It is the “better caramel.”

➡️Low risk, high reward, and familiar enough that you don’t have to explain it.

Authenticity vs Scalability

The Lab is the Bottleneck: Demand isn’t the problem; physics is.

Taking an old recipe and making it shelf-stable at 2,000 lbs per hour usually impacts the texture.

You need to focus on:

➡️Reinventing tradition (Frozen empanadas for the bicultural home).

➡️Playing with combinations (Dulce de Leche coffee creamers for the masses).

➡️Implementing the better for you (Grain-free pan dulce for the gym crowd).

Let’s forget the spreadsheets for a minute. Before talking about a single ingredient, you need to understand the memory you’re trying to encapsulate. This is way beyond chemistry; it’s about the ghost of a flavor you grew up with. And to sell the flavor, you have to understand its soul.

Dulce de Leche is quintessentially Latin American. It goes by many names… manjar in Chile, arequipe in Colombia, doce de leite in Brazil, but its soul is the same: a slow-cooked, milk-and-sugar alchemy that defines comfort. For generations, it was a kitchen ritual. It was a flavor tied to periods of both national prosperity and scarcity, making its presence in the home deeply significant. Today, it’s more often a can of condensed milk boiled in water or a plastic tub pulled from a grocery store shelf. This evolution created a fundamental tension. As Vinka Danitza Woldarsky recalls her mother saying while looking at store-bought versions, “It’s not the same.”

That simple statement is the primary purchasing driver for the bicultural consumer and the primary quality benchmark for the crossover consumer. The brand that can bridge this gap, delivering industrial-scale convenience without betraying a core memory, will dominate the category. The palate is calibrated to an authenticity that is deep, rich, and milky without being cloying. The convenience of a mass-produced spread often comes at the cost of that depth.

This sensory landscape becomes even more complex when flavors combine. Take the humble Ojitos snack: a simple bite of guava pulp filled with dulce de leche. Here, the “tropical and slightly acidic flavor of the guava” collides with the “softness and creaminess of the dulce de leche” to create something greater than its parts. It’s this balance of tart and sweet, firm and soft, that defines the Panadería experience and sets the benchmark for product development.

The cultural currents pulling Latin flavors into the mainstream are powered by undeniable demographic and economic tailwinds.

The Hispanic consumer base in the U.S. is a formidable economic force. The key figures paint a clear picture:

Population: At 63.7 million, Hispanic Americans represent nearly a fifth of the total U.S. population and are the primary drivers of its growth.

Economic Power: This demographic wields an estimated $3.2 trillion in buying power, an economic bloc larger than the GDP of India, France, or the UK.

CPG Impact: Hispanic households are disproportionately influential in the consumer packaged goods sector, accounting for 16% of total CPG growth.

Within the broader food market, the bakery segment presents a particularly fertile ground for this opportunity. The total U.S. baked goods market reached 82.9 billion in 2022 and is forecast to hit 97.7 billion by 2026. Hispanic families are high-volume consumers in this space, making up 20% of all In-Store Bakery (ISB) dessert purchases, including decorated cakes, cheesecakes, and other premium items.

This robust demand is not confined to the Hispanic community. The “Crossover Principle” is the proof-of-concept for the entire Panadería Effect investment thesis. Data shows that Caucasian and Hispanic households purchase Tres Leches cakes at roughly equal rates, proving that authentic Latin desserts, when properly merchandised, have broad, multicultural appeal. It’s the data point that validates moving these flavors from niche ethnic marketing to a more mainstream brand strategy.

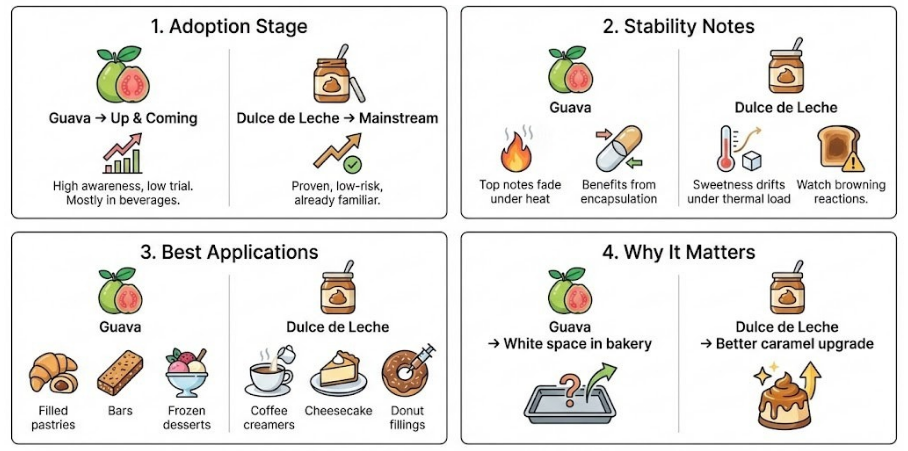

To effectively guide investment and marketing, you have to locate specific flavors on the consumer adoption curve, which typically moves through four stages: Novel, Up & Coming, Mainstream, and Everyday. A flavor’s current position determines whether the strategy should focus on education and trial or on scale and penetration.

Guava is firmly positioned as an “Up & Coming” flavor. Its menu growth is explosive, up 40% in the last four years. Consumer awareness is high at 74%, yet the trial rate is a more moderate 44%, indicating a significant gap between knowing the flavor and trying it. This signals a prime opportunity for CPG products to drive trial. Currently, guava’s presence is overwhelmingly concentrated in beverages, which account for 89% of menu mentions. This lopsided application reveals substantial, untapped potential to introduce guava in its more traditional home: the bakery aisle.

Dulce de Leche is transitioning to “Mainstream”. It has already established a solid presence in U.S. grocery stores, where it’s often merchandised alongside familiar products like Nutella and marketed as a “sweet caramel spread”. Its adoption by industrial giants like Nestlé, with its La Lechera brand, confirms its commercial viability and widespread consumer acceptance. For brands, Dulce de Leche is no longer a risky introduction but a proven performer.

Siete proves that heritage flavors like “Mexican Wedding Cookies” can dominate the grain-free, better-for-you aisle.

A Dutch format carrying a Latin flavor. This validates Dulce de Leche as a functional, low-sugar snack for the general market.

When Starbucks puts guava on the menu, the flavor education phase is over. This proves the average consumer is ready for guava in other formats.

The battle for the panadería aisle isn’t one-dimensional. It’s a street fight between neighborhood artisans who own authenticity, industrial giants who own the distribution network, and a new breed of regional chains trying to prove you can have both. Mapping these competitors reveals the strategic pressures and opportunities at play.

An Industrial Titan: Grupo Bimbo

As the largest commercial bakery in the U.S., Grupo Bimbo’s strategy is built on acquisition and omnipresent distribution. With brands like Sara Lee, Thomas’, and Oroweat, its business model prioritizes national reach and shelf stability. The launch of its “The Rustik Oven” line is a textbook example of its approach: identify a rising trend (artisan-style bread), develop a shelf-stable version in-house, and deploy it through a massive, existing distribution network. For Bimbo, independent bakeries aren’t R&D partners but unpaid focus groups. Bimbo’s strategy is to watch, replicate, and out-distribute.

Artisanal Vanguard

Independent bakeries are the cultural anchors and quality standard-bearers here. Businesses like Panadería Artesana Obando exemplify the journey from traditional craft to modernized innovation, scaling up production with technological investment while never losing the “artisanal essence”. These small enterprises, along with vegan innovators like Soy Concha Bakery, set the authenticity benchmark. They are the R&D labs of the industry, defining the textures and flavors that larger players must seek to emulate.

Regional Scalers

A potent threat is emerging from fast-growing, culturally focused chains that successfully blend quality with a scalable model. CAO Bakery & Café, the fastest-growing Cuban bakery chain in South Florida, demonstrates that a high-quality, culturally-rooted concept can expand rapidly within a target market. These regional scalers prove the business model’s viability and often serve as acquisition targets for larger firms looking to buy, rather than build, authentic product expertise.

Dulce de Leche: The Versatile Caramel

If guava is the growth engine, Dulce de Leche is the versatile and reliable workhorse. As an established flavor, its primary role is as a filling, topping, and spread across a vast range of products, from breakfast cereal and donuts to premium cheesecakes. Its strategic value lies in its ability to serve as a premium, authentic upgrade to standard caramel. For consumers, it offers a familiar yet elevated experience. For CPG brands, it’s a low-risk way to introduce Latin authenticity into existing product categories, adding a layer of indulgence.

Guava: The High-Growth Tropical Core

Guava presents a compelling, data-backed business case as a high-growth engine. It now ranks in the 58th percentile for consumer preference among all foods and flavors, meaning consumers love guava more than 58% of all other items. This combination of familiarity and rising popularity makes it a prime candidate for mainstream product lines. Its versatility is a key asset; it pairs exceptionally well with proven sellers like strawberry, which is the top flavor paired with guava globally. It also functions effectively in both sweet applications (pastries, french toast, jam) and savory ones (bbq sauce).

The foundation of authenticity: Sourcing high-quality, natural ingredients is the first step in translating traditional Latin flavors to the mainstream CPG market.

Thermal Stability: Traditional flavors lose intensity quickly during baking due to high volatility. If application requires high-heat processing, consider heat-stable flavor technology (like encapsulated flavors) that can withstand temperatures up to 250∘C. This technology significantly reduces flavor loss during baking and prolonged storage.

Replicating Texture: True authenticity relies on sensory attributes, especially texture. For soft breads (Conchas) or layered products (flaky pastry), maintaining the required sensory profile demands dedicated food science R&D focused on reverse-engineering artisanal crumb structure for high-volume, automated production.

Alternative Flours: To meet the demand for gluten-free and grain-free options (a trend where Hispanic consumers over-index by 22%), explore cassava (yuca) flour. It serves as a viable, functional replacement for wheat flour in traditional pan dulce formats.

thank you for reading!