GLP-1 (glucagon-like peptide-1) is a hormone produced in the gut that helps regulate blood sugar levels by stimulating insulin secretion and slowing gastric emptying. It also reduces appetite, making it a key target for weight-loss and diabetes medications.

There’s something unsettling about a drug that can make someone walk past a doughnut shop without breaking stride. Yet that’s precisely what’s happening across America, where appetite-suppressing GLP-1 medications have shifted from diabetes treatment to cultural phenomenon in the span of two years.

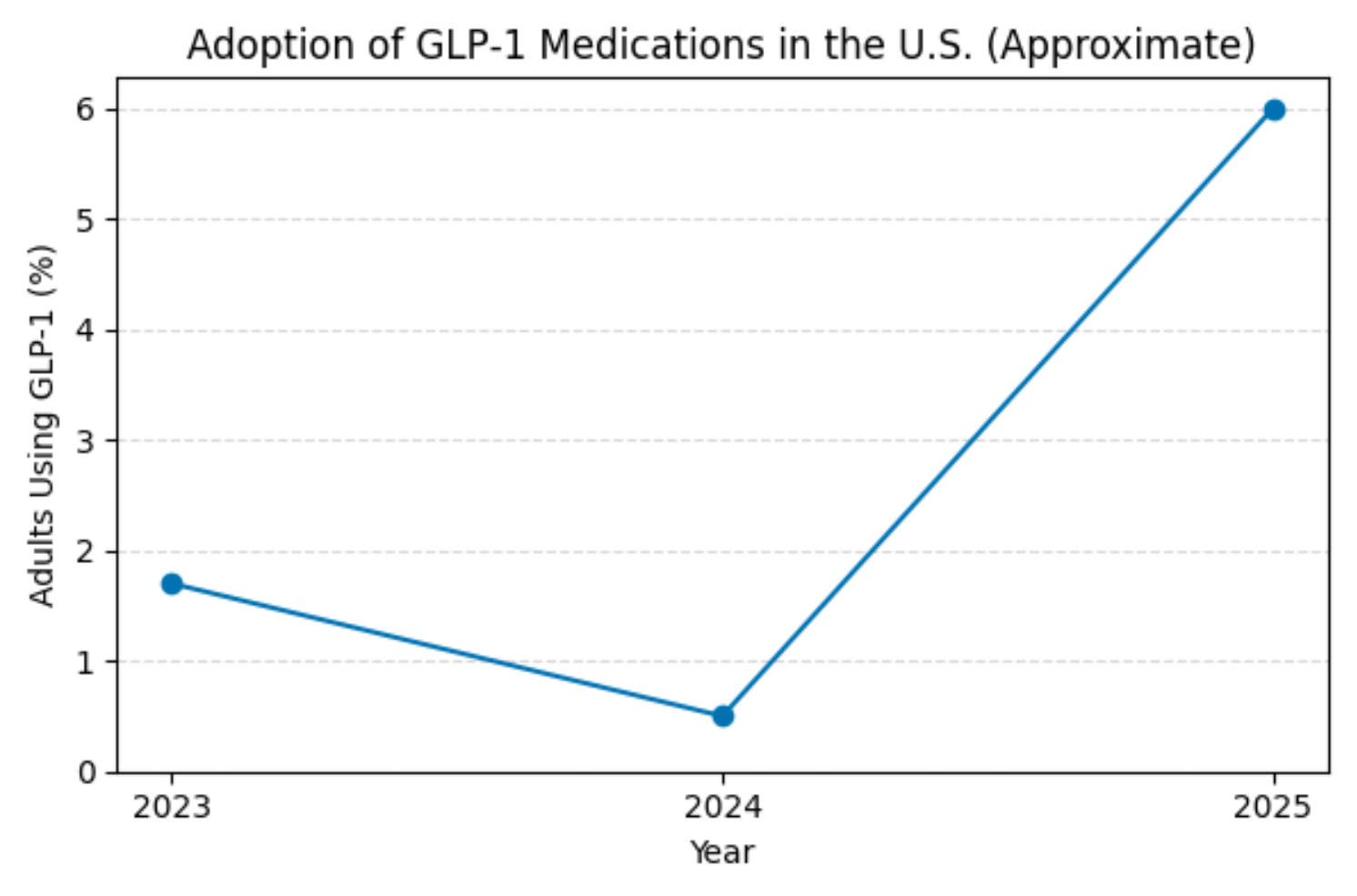

What began as Novo Nordisk’s Ozempic and Wegovy, joined by Eli Lilly’s Zepbound, has evolved into something more profound than mere weight-loss therapy. By early 2025, roughly 20 million Americans (6% of adults) were using or had recently used these drugs, up from 1.7% in late 2023. Investment banks project adoption could reach 50 million within a decade, creating what amounts to a parallel food economy.

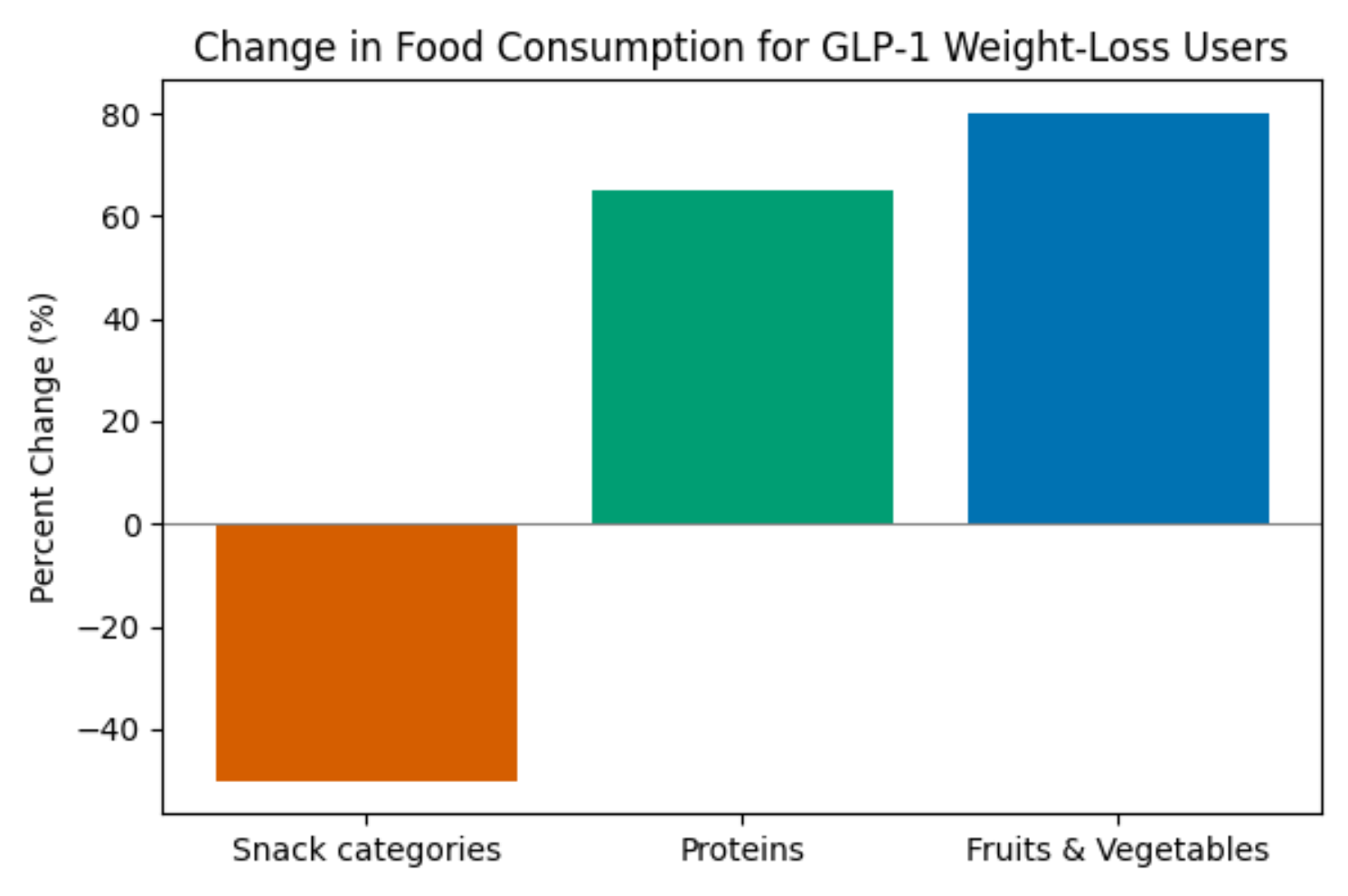

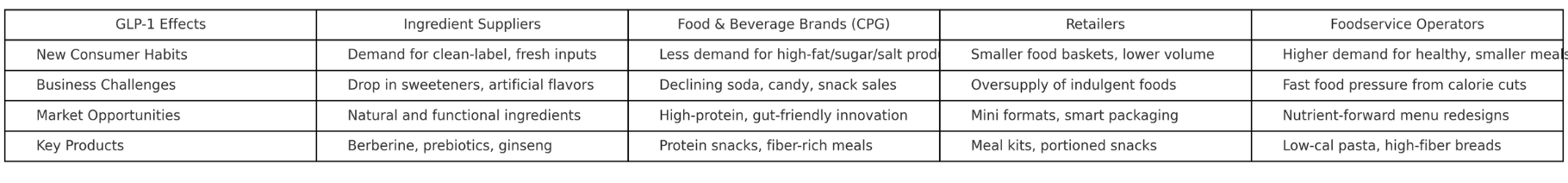

Users now consume 30% fewer calories and slash restaurant and grocery spending by 20-40%. This becomes more visible in categories where margins traditionally run highest: snacks and sugary beverages are already facing some backlashes, while lean proteins, fruits, and vegetables see increased demand. Goldman Sachs estimates the total damage at $12-48 billion annually in lost food and beverage sales.

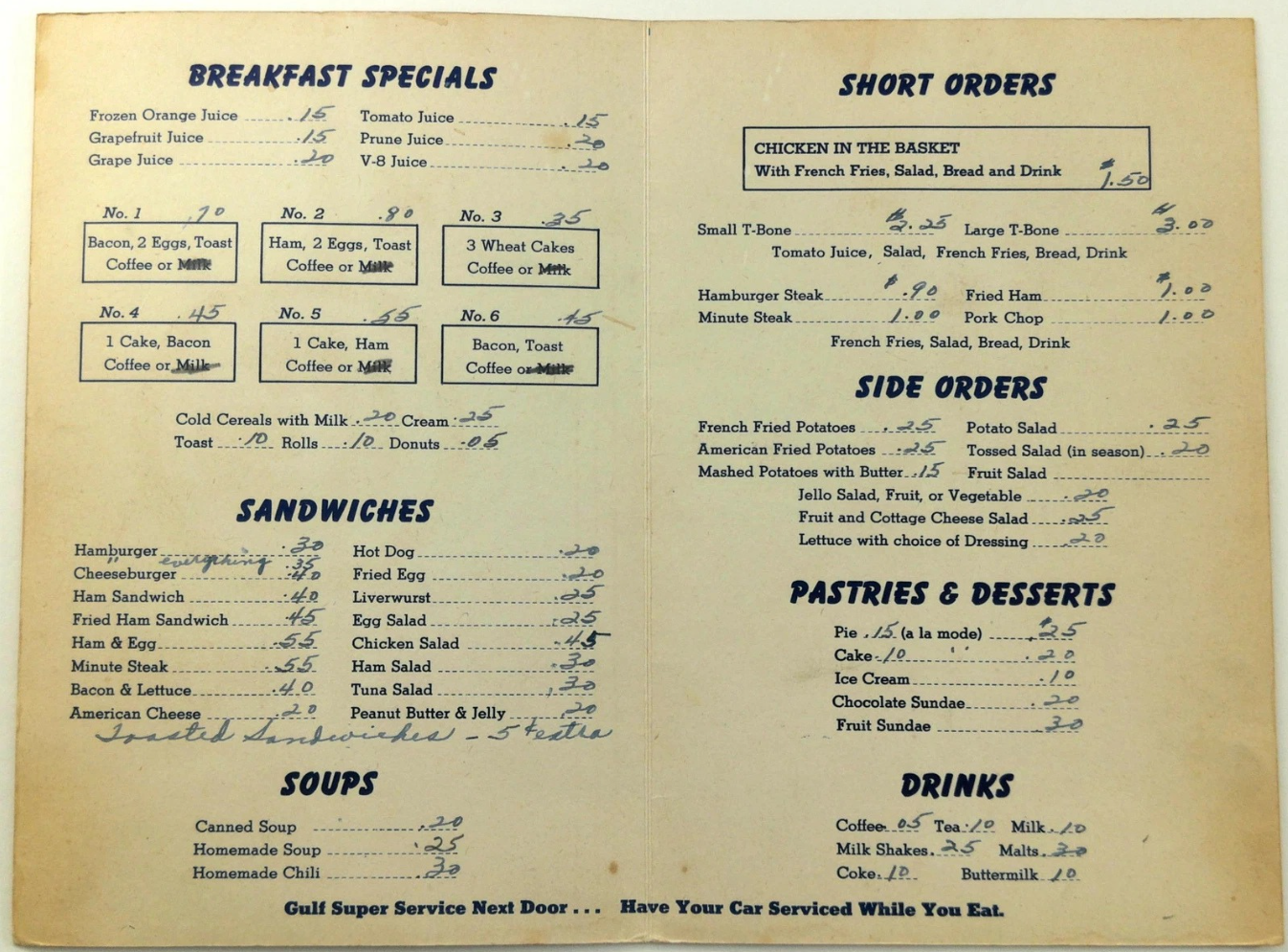

For flavor houses, this represents an existential reckoning. These drugs don’t merely suppress appetite but they rewire taste perception itself by playing with the dopaminergic reward systems. Users develop aversions to sweetness, fat, and bitterness while becoming hypersensitive to texture and nutrient density. Suddenly, the industry’s century-old playbook of sugar, salt, and fat feels as obsolete as a diner menu from 1952.

Yet therein lies opportunity. When hunger is no longer guaranteed, satisfaction must be earned through craft rather than chemistry. The companies that survive this pharmacological disruption won’t be those clinging to the old formulas of engineered addiction, but those bold enough to rediscover what made food compelling before we learned to weaponize the pleasure centers of the human brain.

The GLP-1 revolution is forcing American food culture to grow up. Whether the industry is ready for that conversation remains an open question.

Early surveys suggest that adoption is accelerating. In 2023, around 1.7 % of Americans had been prescribed semaglutide. By early 2024, 0.5 % of U.S. adults were using GLP‑1 drugs, and by mid‑2025 around 6 % (≈ 20 million people) were currently using or had recently used them. Projections by consultancy EY‑Parthenon anticipate 13-21 % of adults (30-50 million people) taking these drugs within a decade, a scale comparable to the early days of diet soft drinks.

But here’s the twist that should terrify food executives: a staggering 53.6% of users abandon treatment within a year, with 75% gone by year two; casualties of cost, side effects, or the inevitable plateau. The pharmaceutical companies may have created a subscription model, but their customers keep cancelling.

What they can’t cancel, however, are the neural pathways that have been rewired. Even former users report lasting changes in taste preferences and eating habits. The industry is not only losing customers temporarily; but it’s also watching them graduate to an entirely different relationship with food, one that values restraint over indulgence, quality over quantity.

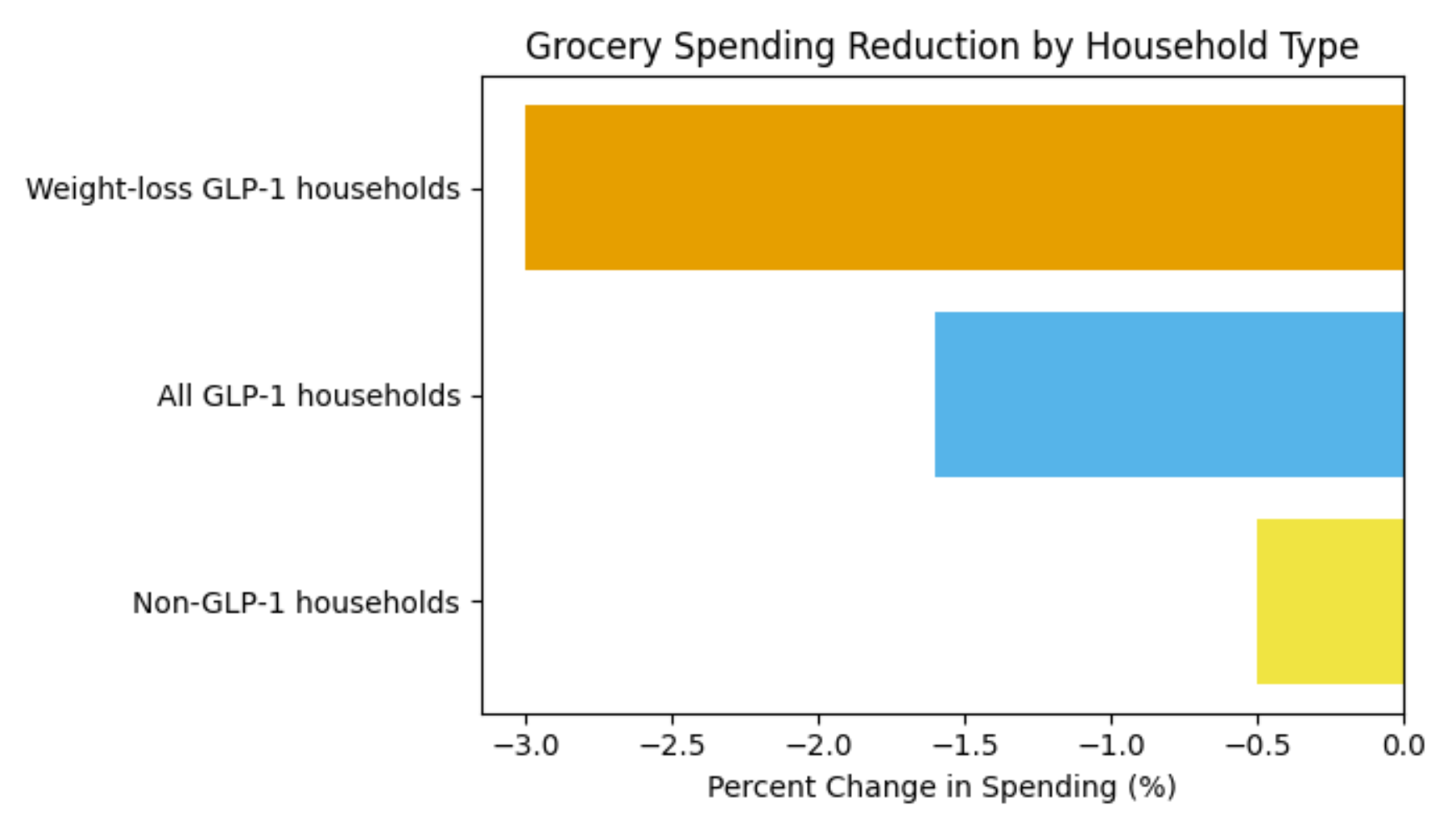

Cornell University’s data reveals that households with even one GLP-1 user slash grocery spending by 6% within six months, 9% among the affluent, who can afford both the drugs and the luxury of eating less. Morgan Stanley found that users consume 21% fewer calories overall, with nearly a third spending measurably less on groceries.

Restaurants are suffering worse. GLP-1 users cut takeout and delivery spending by 61%, dining out by 63%, and visit restaurants half as often as they once did. The mathematics are merciless: billions in lost revenue across an industry built on the assumption that Americans would always want more.

But the real story lies in what replaces the old consumption patterns. When GLP-1 users do shop, their baskets change. Snack purchases plummet 40-60% while protein consumption surges 65% and produce sales jump 80%.

The contrast is stark: households with GLP-1 users cut food spending six times faster than their unmedicated neighbors. Barclays estimates total basket shrinkage at 10%, with some packaged food categories seeing 40% declines. We’re witnessing a pharmacologically-induced rejection of the American way of eating.

Kraft Heinz and Campbell’s have already begun their mea culpas to investors, acknowledging what the data makes brutally clear: brands built on engineered indulgence are dying. Morgan Stanley projects $12 billion in damage to the U.S. snack market over a decade, $7 billion from salty snacks, $5 billion from sweet ones. These are not rounding errors… but rather obituaries for entire product categories.

Even the ostensibly health-conscious aren’t immune. Conagra’s Healthy Choice and Nestlé’s Lean Cuisine (products designed for the calorie-counting consumers) are being abandoned by GLP-1 users who’ve moved beyond processed approximations of nutrition. The industry’s response has been swift if somewhat desperate: Conagra now claims “GLP-1 friendly” badges on reformulated meals, while Nestlé launched Vital Pursuit, sounding more like a supplement catalog than a frozen food range.

“GLP-1 friendly” frozen meals with 20g+ protein, low sugar, and high fiber, flavors include Chicken Marinara, Turkey Sausage Lasagna, Tex-Mex Chicken Bowl, and BBQ Seasoned Pork.

Targeted at GLP-1 users, this line leans clinical: high-protein bowls, whole grain flatbreads, and nutrient-boosted sandwiches with meals such as Chicken with Super Grains, Turkey Sausage Egg Bites or Chicken Mozzarella Pizza.

Yet for every loser, there’s a winner riding the protein wave. Meat snacks, Greek yogurt, and nutrition bars are experiencing unprecedented demand. General Mills explores protein-fortified everything; PepsiCo and Mondelez scramble to launch high-protein offerings that would have seemed absurd five years ago. Most ironically, the plant-based sector, after years of overhyped underperformance, may finally find its moment by delivering nutrient density in smaller portions, perfectly aligned with the GLP-1 user’s preference for quality over quantity.

What happens when you chemically reprogram the human palate? IFF, for example, has been asking that question in laboratory conditions. Their proprietary research reveals that 85% of GLP-1 users experience fundamental shifts in taste preferences, not mere dietary adjustments, but neurological rewiring of pleasure itself.

The casualties are predictable: fatty dishes, deli meats, sweets, coffee, and alcohol all trigger newfound revulsion. Mouthfeel becomes paramount; users reject anything dry, sticky, or dense. Meanwhile, they develop almost immense cravings for lean proteins, fresh produce, and what the industry calls “hydration-oriented beverages.” Some report heightened sensitivity to bitterness and artificial sweeteners, suggesting these drugs don’t merely suppress appetite but rather alter the fundamental wiring between tongue and brain.

Traditional flavor development relies on sugar, fat and salt to deliver satisfaction. GLP-1 users often find these cues unpleasant or unnecessary. Actors of the flavor industry must therefore reduce sweetness and fattiness while enhancing umami, savoriness and freshness.

In this new world, umami emerges as the unlikely savior, now suddenly essential. Japanese fermentation masters knew something we’re only now getting: true satisfaction doesn’t require excess. Kombu, shiitake, miso… they all deliver complexity without the caloric baggage that modern consumers increasingly reject.

Botanical extracts, herbs, spices and acidic notes can provide complexity without relying on high calories.

Some common challenges include:

Bitterness masking and balancing.

As GLP‑1 drugs heighten sensitivity to bitterness, adding natural bitter blockers or layering subtle sweetness can help maintain palatability. Companies may also use fermentation-derived amino acids to deliver depth.

Texture modification

Because GLP‑1 users reject dry or dense foods, incorporating hydrocolloids, proteins and fibers can create moist, satisfying textures. Dairy‑alternative products may need to replicate the creaminess of fat without high caloric loads.

Savory and fermented notes.

Umami‑rich ingredients such as mushrooms, miso, seaweed and yeast extracts can deliver satisfaction with lower salt levels. Fermented products not only add complexity but also align with the wellness narrative.

Protein’s Bitter Truth

The protein imperative presents its own challenges. High-protein formulations carry the bitter, chalky signatures of their functional origins, flavors that speak of necessity rather than pleasure. Flavor scientists must therefore master the art of transformation, turning nutrition to celebration (and salivation).

As we peer into the next decade, three scenarios emerge.

In the base case, 10-15% adoption creates a $30-50 billion market disruption, forcing steady innovation in umami profiles and portion control.

The high-impact scenario, 20% adoption driven by Medicare coverage and generic competition, could trigger a $90 billion market contraction and fundamental industry restructuring.

The low-impact scenario keeps disruption to $12 billion, treating GLP-1 as an interesting niche rather than a cultural earthquake.

But even in the most conservative projections, the implications for flavor chemistry are profound. We’re witnessing the birth of post-appetite cuisine, food designed not to trigger hunger but to satisfy it efficiently, elegantly, with minimal collateral damage to waistlines or wallets.

Indulgence to intention, three outcomes, one transformation. GLP-1 is reshaping how we define satisfaction.

In the end, the GLP-1 revolution forces us to confront a fundamental question: when hunger is no longer the primary driver of food choice, what is? The answer, it seems, lies in rediscovering the craft, culture, and chemistry that made food meaningful before we learned to engineer addiction into it.

The future belongs to those who can create desire without desperation, satisfaction without excess, pleasure without the pharmaceutical intervention of artificial appetite. It’s a return to food as nourishment rather than narcotic, and for an industry built on the latter, it represents nothing short of a complete reinvention.

As any great chef will tell you, constraint breeds creativity. The GLP-1 era is about to test that theory on an unprecedented scale. Those who succeed won’t just survive the revolution but they will help define what American food culture becomes when appetite is no longer a given, but a choice.

When hunger no longer leads, intention must. The future of food is not what we desire, but what we choose to create.

thank you for reading!