Kava is a fascinating plant-based beverage that’s been quietly making waves in wellness circles, though it’s actually been around for about two thousand years in some cultures. Originating from the Pacific Islands, this muddy-looking drink is made by grinding up the roots of the kava plant and mixing them with water.

While it might not win any beauty contests with its very earthy taste and unappetizing appearance, kava has served as a cornerstone of Pacific Island culture for over two millennia, traditionally used in ceremonies to welcome guests and celebrate special occasions.

What’s really caught people’s attention lately is kava’s potential as a natural alternative to alcohol and pharmaceutical anxiety medications. The secret lies in six unique compounds called kavalactones found in the plant’s roots, each offering different effects from mood enhancement to pain relief.

First kavalactone: Increases dopamine levels, producing euphoric feelings

Second kavalactone: Boosts GABA (gamma-aminobutyric acid) levels, helping regulate emotions and reduce anxiety

Third kavalactone: Calms the central nervous system, easing pain and promoting sleep

Fourth kavalactone: Also calms the central nervous system for pain relief and sleep support

Fifth kavalactone: Increases serotonin levels, regulating mood, appetite, and sleep

Sixth kavalactone: Also increases serotonin (serotonin deficiency can cause anxiety and depression)

Perhaps most intriguingly, kava works in reverse compared to most substances, meaning that instead of building tolerance, it actually becomes more effective the more you use it, which explains why first-timers often feel nothing at all.

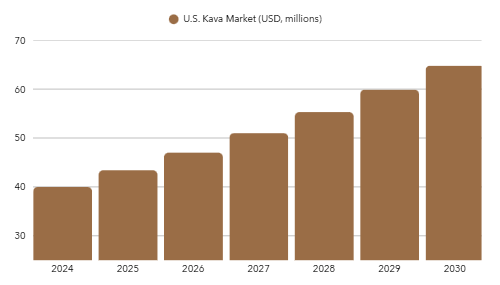

Although starting from a small base, the U.S. kava beverage market (including powders, shots, and RTD drinks) is on a strong growth trajectory through 2033. Global kava product sales were about $1.6 billion in 2024 , with U.S. demand only a fraction of that (~$40 million in 2024 ) but expanding rapidly. Projections call for double-digit annual growth worldwide (≈14% CAGR) and the U.S. market roughly doubling by 2033, driven by wellness trends and new product formats.

The rise of kava in America is pretty remarkable when you look at the numbers.

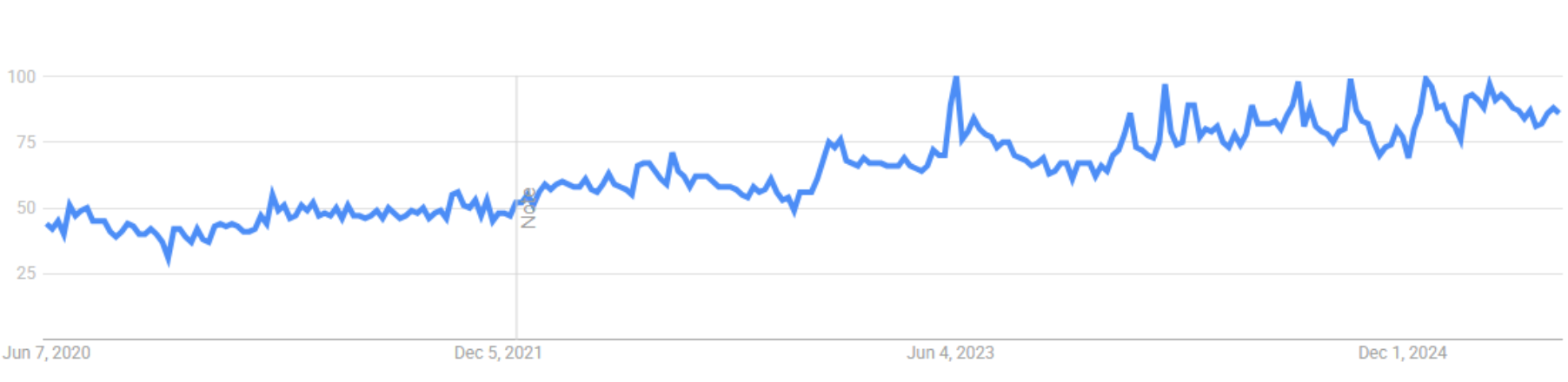

Online searches for kava bars have jumped 300% since the mid-2010s, and it’s easy to see why – people are genuinely curious about this alcohol-free way to socialize and unwind. Millennials and Gen Z are especially drawn to it, part of their broader interest in functional drinks like adaptogens and CBD. The idea of a “kava bar” (basically a chill lounge where you can hang out and drink kava instead of alcohol) has gone from something most people had never heard of to a legitimate social option. What really seems to hook people is the promise of relaxation without the hangover, which has gotten plenty of media attention and sparked even more interest in trying it out.

Kava drinks occupy a strategic niche at the intersection of the wellness, non-alcoholic, and functional beverage trends. For consumers, kava serves as a “third category” of social drink, neither intoxicating alcohol nor a simple soft drink, but something in between: a relaxing, mellow brew that can be enjoyed socially for its mood-enhancing effects

What’s smart about how kava is being marketed is the three-pronged approach brands are taking. First, they’re going hard on the alcohol alternative angle – kava seltzers literally advertise “relaxation without the hangover,” which is catip for sober-curious people or anyone tired of feeling terrible the next day. Kava bars are positioning themselves as “sober bars” where you get all the social atmosphere of a pub without the alcohol.

Second, they’re leveraging the wellness trend by grouping kava with other functional beverages that promise stress relief and mood benefits. For health-conscious consumers who might otherwise use supplements for anxiety, kava offers both the experience and the perceived benefit in one drink.

Finally there’s the cultural angle. Kava comes with this rich South Pacific heritage that some brands lean into, complete with coconut shells and traditional greetings like “Bula.” It’s a way to make the drinking experience feel special and authentic rather than just another beverage choice.

For a flavor house, kava beverages represent a chance to support innovation in a burgeoning category that could become mainstream in the next decade if current trends continue

|

Format |

Example Leading Brand |

Key Features & Notes |

|

Traditional Kava Powder (for mixing) |

KALM

|

Finely ground or micronized kava root. Prepared by mixing with water (often using a strainer). Offers the most authentic experience and highest kavalactone potency. Primarily unflavored (earthy, bitter taste), consumers may mix in juice or coconut water. |

|

Ready-to-Drink (RTD) Cans (sparkling or still) |

Leilo

|

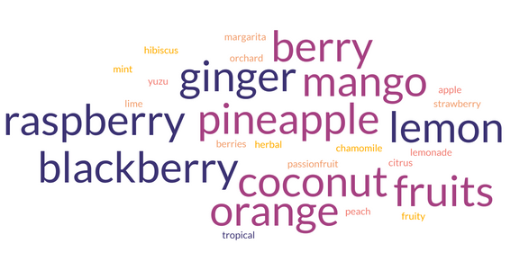

Pre-mixed kava beverages similar to a soda or seltzer. Usually flavored (fruit and botanical flavors) and lightly sweetened for palatability. Each 12oz can typically contains a standardized kava extract dose (e.g. Leilo has 1000 mg kava extract per can ). Marketed as relaxation drinks. |

|

Concentrated “Kava Shots” (2–4 oz) |

mitra9

|

Small, concentrated liquid shots that provide a quick dose. Typically 2 oz bottles, these often combine kava extract with other herbs for a synergistic effect. Due to potency, strong taste is masked with sweeteners and flavors such as pineapple and coconut juice |

|

Kava Concentrates & Mixers (liquid or paste) |

TRU KAVA

|

High-strength extracts used to mix into other drinks or take sublingually. These can come as tincture drops, syrups, or thick pastes. Highly standardized kavalactone content, ensures consistency and longer shelf life. However, they can be very bitter; often require a chaser or sweet mix. |

|

Kava Drink Mixes (Flavored powder sachets) |

Leilo Drink Mix

|

Powdered drink mixes that contain kava extract plus flavorings, meant to be stirred into water or juice. Mostly flavored to mask kava bitterness (e.g. fruit punch or lemonade flavors), and no need for straining. |

Emulsion and Solubility: Kavalactones (the active compounds in kava) are not very water soluble; they’re more soluble in fat or alcohol. Since kava drinks are water-based and nonalcoholic, achieving a stable dispersion of kavalactones is tricky. Formulators often use emulsifiers or surfactants to keep the kava extract in suspension. Lecithin, gum arabic, or modern nano-emulsion technology can help uniformly distribute kavalactones so they don’t separate or cling to container walls. This is especially important for shelf stability; a good emulsion will prevent the active ingredients from settling out over time . Products like kava shots, which are highly concentrated, need robust emulsification to avoid a film or precipitate (consumers won’t shake a tiny shot vigorously). Additionally, if using oil-based flavors or other extracts, compatibility with the emulsion system matters. Developers may borrow techniques from the cannabis beverage industry (another fat-soluble actives scenario) to create clear, stable kava drinks.

Shelf-Life & Preservation: Traditional kava (prepared from root and water) spoils quickly; it’s essentially an unpasteurized tea that can go bad in a day. Commercial kava beverages must be formulated for a reasonable shelf life. Preservatives (like potassium sorbate, sodium benzoate) or pasteurization methods (flash pasteurization, or hot-filling for shelf-stable bottles) are commonly employed . High-pressure processing (HPP) is another technique that could preserve a kava drink without heat, thus protecting some volatile flavor components. However, any heat or extreme pH could potentially degrade kavalactones, so companies must balance microbial safety with active potency.