North American interest in West African cuisine is surging, as adventurous eaters and diaspora communities drive demand. For example, West African food was part of the top trending US cuisines in 2023 (+72% YoY), and online searches for dishes like Nigerian jollof rice spiked (+250%) and egusi (+120%). Functional ingredients are a bright spot: baobab ingredients (a vitamin C-rich African superfruit) had a $5.2B global market in 2022, forecast to reach $8.2B by 2031, with North America leading adoption. These trends coincide with retailers expanding West African SKUs: for instance, Ayo Foods’ frozen jollof rice and groundnut stew lines (shown) have landed in major chains (Target, Sprouts). But with any new traditional flavors come a couple challenges. Yet those willing to face those challenges will reinforce their position within the booming niche.

Note: Moat means a barrier that protects a business from competitors, like a unique advantage or defense that’s hard to copy.

Walking the aisles of an international market or a bustling food hall, West African staples are no longer hidden. The scent of suya skewered beef coated in a fiery, peanut-ginger rub, drifts from a Minneapolis pop-up, mingling smoke, ground peanuts and tropical chili. Jollof rice (tomato-spiced rice) often comes with fried plantain and boiled egg, its complex smokiness and scotch-bonnet heat reminding diners of Cajun jambalaya but with distinctly earthy depth. At a recent Atlanta street fair, locals lined up for bowls of egusi soup, a creamy melon-seed stew with leafy bitter greens and smoked fish, and plates of akračakra (bean fritters) that crackle on the tongue. Consumers describe these flavors as exotic but yet comforting: many ingredients (peanuts, sweet potatoes, rice, onions, peppers) that are already “relatable” here in the US.

Jollof rice with fried plantains, the smoky, spicy core of West African cuisine now finding its place in US kitchens and festivals.

This cultural wave was years in the making: global hits from Burna Boy and Davido, and initiatives like Ghana’s 2019 “Year of Return,” gave African chefs a megaphone. Today the proof is in the puddin’, or rather, the jollof. Atlanta now hosts an annual Jollof Festival, and social media feeds fill with jeje (quiet party) vibes as influencers share bowls of fufu (pounded yam) with spicy palm-soup. The Field Notes are clear: West African cuisine is vibrant, communal and unforgettable, and US consumers are more than ready to join the party.

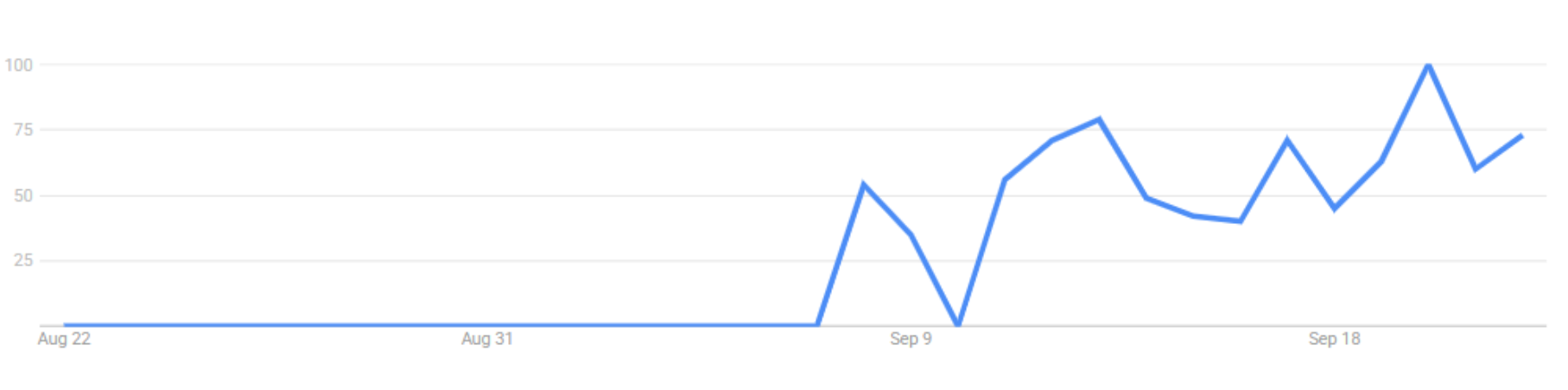

Growth in West African flavors is measurable. CPG launches and menu mentions have climbed sharply. At the same time, online recipe searches for key dishes like Nigerian jollof (+250%) and egusi (+120%) have spiked. This is reflected in the retail pipeline: dozens of specialty sauces, soups and frozen meals now carry West African branding.

West African Cuisine interest over time (2025)

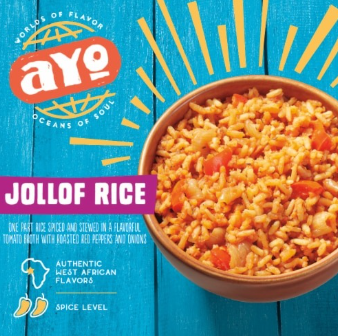

Public markets echo this enthusiasm. Retail trailblazers report fast gains: frozen West African meals (jollof rice, groundnut/egusi stew) and condiments are reaching mainstream shelves. In 2024 Ayo expanded distribution into major US chains (Target, Sprouts, etc.), a sign retailers see “latent demand for a more diverse set of offerings”.

Brands like Ayo Foods now package authentic jollof (as shown) in the freezer aisle.

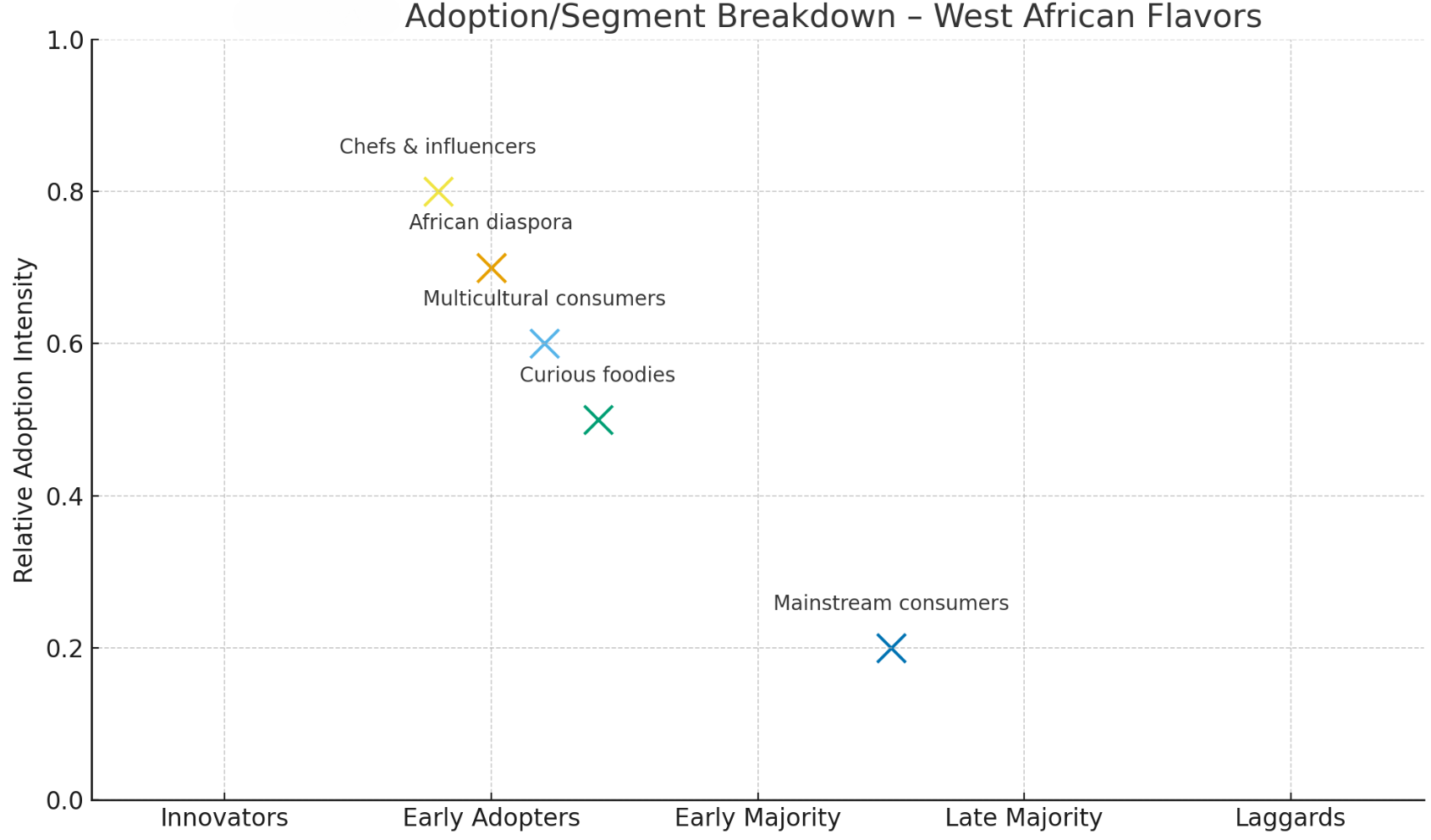

Who’s buying all this? Early adopters include African diaspora communities (millions of West African immigrants and descendants in US/Canada) alongside adventurous millennials and Gen Z “flavor explorers.” Surveys suggest a large pool of potential tasters: one foodservice analyst found ~45% of Americans were eager to try African cuisines. Within this wave, two archetypes emerge: Cultural connectors and Safe-adventure seekers. Cultural connectors are immigrants and their families who want a taste of home but now expect convenience (ready meals, familiar-sauce bottles). Safe-adventure seekers are urban foodies and wellness shoppers who crave new ethnic flavors as “exotic comfort”, flavors like baobab’s citrusy tang or the nutty heat of groundnut sauces fit the bill.

The graph conceptually maps segments by adoption stage; note that usage is concentrated at specialty and urban outlets so far.

Young consumers embrace these flavors in fusion restaurants and food halls. Data-backed trends show this: West African cuisine was the top 2023 growth category in the US (72% jump), helped by the fact that many core ingredients (peanuts, rice, onions, peppers, yams) are already accepted by American palates

West African cuisine surges with US diners.

The competitive landscape spans multiple categories. On one axis are product types (spice blends, sauces, frozen meals, snacks, beverages, ready-to-eat street-food), and on the other are customer moats (ethnic niche vs. mainstream). Currently, specialty brands and importers dominate the ethnic aisle: pepper sauces, peanut soup mixes, fonio grain. Large CPG players are just entering: for instance, several manufacturers have launched West African-inspired marinades and nut butters. Meanwhile, foodservice competition is heating up (smaller chains and fast-casual spots are adding jollof and suya tacos).

West African spice rubs now showing up in US fast-casual tacos.

Ingredient suppliers have scaled up, US demand is fueling imports of baobab, moringa, hibiscus etc., so that functional-ingredient companies can claim a “first-mover” advantage. North America is already a leading market for these superfruits (baobab usage is soaring in health foods). Yet significant white space remains in mid-tier product tiers (e.g. affordable West African-flavored snacks or sauces) where few national brands exist. Innovative moats like ethical sourcing (fair-trade spice supply) or health positioning (high-fiber fonio snacks) are emerging as barriers to entry.

The boom in West African flavors demands innovation. Flavor houses must build authentic profiles of complex spice blends and ingredients, meaning smoky-peanut depth (for suya), nutty vegetal richness (egusi soup), rich palm fruit notes (banga soup), and tangy berry accents (hibiscus drinks). Traditional seasonings like dawadawa (fermented locust bean) or iru (Ogiri) will require fermentation expertise and careful QC. Key new ingredients are entering labs: baobab powder (tart, citrusy) and moringa leaf (green, earthy) are now on flavor wheels, used for vitamin and chlorophyll notes. The Perfumer & Flavorist reports highlight baobab as an “emerging superfruit” (6× the vitamin C of orange, high fiber), and moringa as a protein-rich green used in snack bars.

Baobab and moringa, superfruit and superleaf now making their way from African farms into North American labs.

Flavor formulators should also adapt process techniques. For example, peanut paste in suya is often dry-roasted; replicating that “dusty roast” flavor may involve pyrolyzed notes. Hibiscus (zobo/ bissap) needs astringency without bitterness, blending citrus or vitamin C can help. Egusi (melon seed) tends toward bitterness unless balanced by cocoa or sesame notes. Labs must also ensure consistent sourcing: West African crops face seasonality and supply-chain hurdles. QC flags include peanut/allergen controls and aflatoxin screening in groundnuts, heavy-metal screening in herbs, and pesticide residues in hibiscus/roselle. Regulations demand kosher/halal certs for exported spices. The upshot for R&D: focus on scalable, functional extracts (e.g. baobab powder as a natural acidifier, fonio flour as a gluten-free starch), and invest in rapid prototyping of regional blends.

To capitalize on this wave, companies can take these steps:

Partner with diaspora experts. Collaborate with West African chefs and communities to co-create authentic recipes or endorse products (e.g. a jollof meal kit or suya rub). Cultural credibility is a moat.

Expand product lines. Develop new SKUs featuring core West African components: peanut-based sauces (groundnut/maafe flavors), Scotch bonnet hot sauces, hibiscus-sweetened beverages, and fonio or cassava snacks. Position them as superfood or plant-based where possible.

Leverage health/heritage marketing. Highlight nutritional angles: baobab’s vitamin C, moringa’s protein, egusi’s plant protein and fiber. Use storytelling (e.g. “sun-dried baobab fruit from Senegal”). Millennials value authenticity.

Monitor regional trends. Keep an eye on fast-evolving cuisines. For example, Ghanaian chili sauces or Nigerian vegan brands might be ready for North America in a couple of years. Early pilot projects (LTOs, small-batch test markets) can gauge interest.

Sensory Lexicon:

Suya/spice rub: smoky-roast peanut, medium-high chili heat (Scotch bonnet), ginger/garlic aromatics.

Egusi soup: creamy nutty (melon seed oil), gentle bitterness (leafy greens), earthy umami (fish stock note).

Akara/bean fritter: fried bean paste (savory-bitterey), slight onion note.

Formulation Tips: Use dry-heat processing to mimic smoky notes; consider roasted peanut paste as flavor base. For baobab, powdered acidulant (mix ~2-5% ascorbic acid in water extracts to standardize tartness). Egusi kernels yield stable emulsions, use as dairy fat analog. Kuli-kuli (groundnut snack) suggests a crunchy peanut oil binder for bars. In beverages, balance hibiscus with sugar or agave (1:1 pH drop to ~3.0 for stability). Fermentation or enzymatic hydrolysis can simulate dawadawa/iru umami (gas-generated amino acids).

Nutrition/Claims: West African ingredients map to “healthy” claims. Egusi is high in protein and folate (frame as vegetarian protein source). Baobab = high fiber + vitamin C (fiber content ~50%, vitC up to 300 mg/100g). Hibiscus = anthocyanins and lowers blood pressure (use heart-health claim where allowed). Fonio grain (if used) is gluten-free and low-glycemic. Claims must be validated by testing local standards (FDA/Nutrition Facts, GDAs).

QC/Safety: Watch allergens (peanut, tree nut analogs from seeds). Screen for aflatoxins in groundnuts and okra powder. Test pesticides in tropical herbs. Ensure heavy metals below USP limits for botanical extracts. Verify botanical authenticity (e.g. hibiscus sabdariffa vs. Hibiscus tiliaceus). Use standard microbial kill steps for raw cassava (cyanide hazard) and beans. For sauces, control water activity (aw<0.85) to prevent spoilage.

thank you for reading!

Sources