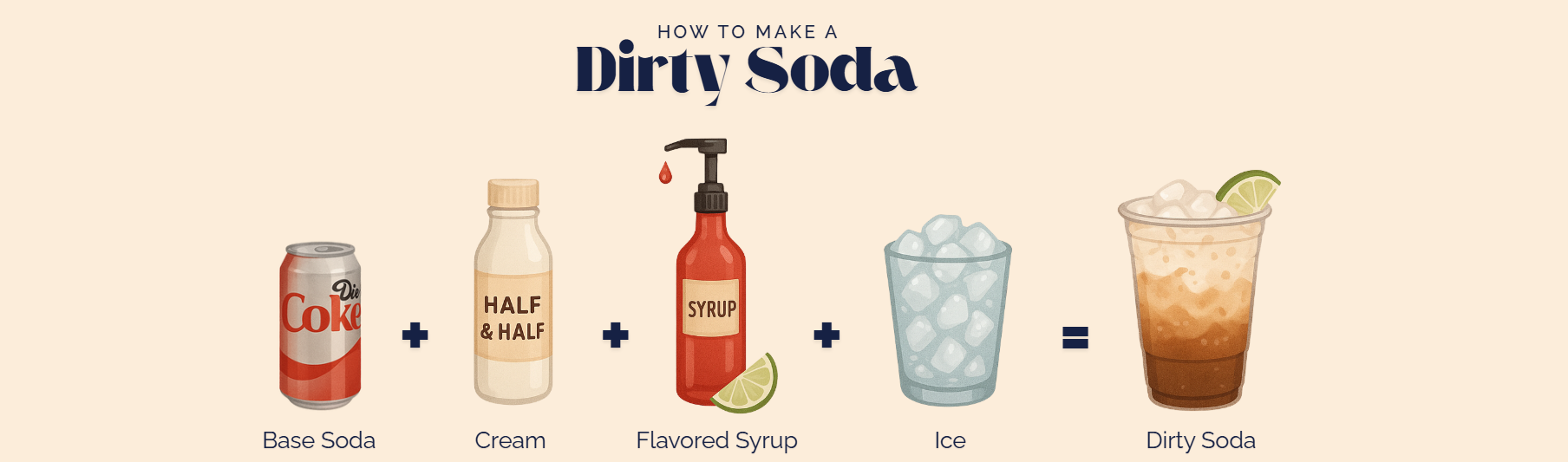

Dirty soda is what happens when you realize that soda doesn’t have to be the final product. On one hand you have a fountain Coke and on the other you have some coconut syrup. Add in some squeeze fresh lime and now you’ve got a drink that tastes like a melted ice cream float. Born in Utah’s Mormon community over a decade ago (where creative non-alcoholic drinks are almost an art form), dirty soda stayed happily regional until TikTok got hold of it. Now it’s everywhere, from chains like Swig or Sodalicious making it their core business, to bartenders changing them with their own “interesting” creations, such as El Doctoro, a mix of Dr Pepper and Horchata.

Now let’s talk about what this actually means in dollars and cents. The dirty soda market has grown from essentially nothing to an estimated $70+ million industry in just a decade.

To put this in perspective: the entire U.S. soft drink market is worth about $55 billion annually. So dirty soda is still a tiny slice of the pie (less than 0.2% by value). But what’s interesting about trends is that they don’t need to be huge to be hugely influential. For every $500 Americans spend on soda, maybe $1 goes to dirty soda. But that $1 is generating a disproportionate amount of buzz, innovation, and margin expansion.

The profit margins alone explain why everyone wants in. A typical dirty soda costs about $0.70 in ingredients and sells for $3-5, delivering gross margins that can hit 80%. Compare that to regular fountain drinks, where margins are already pretty good, and you can image why operators are pretty eager about it.

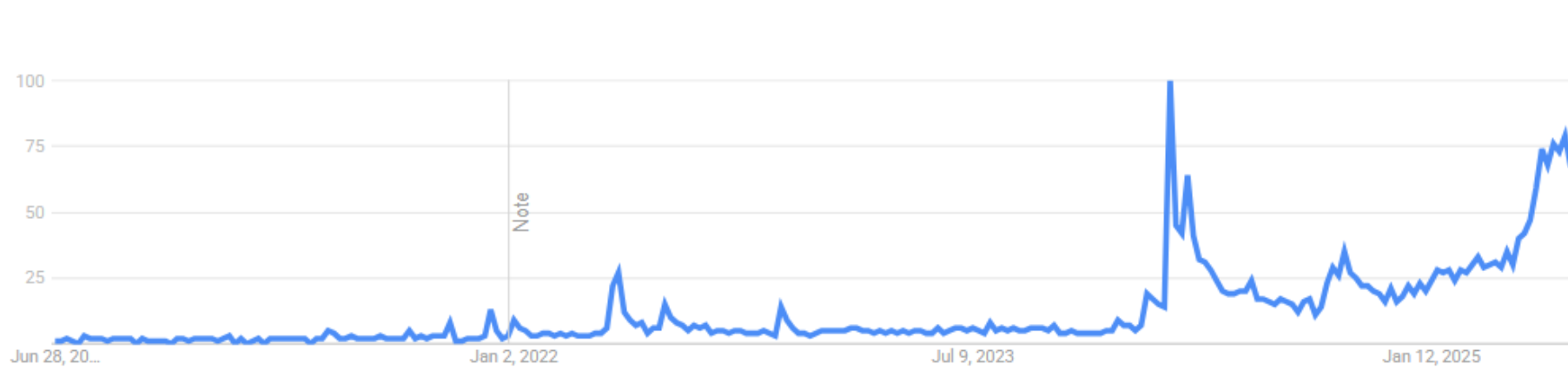

Interest over the past 5 years (Google Searches)

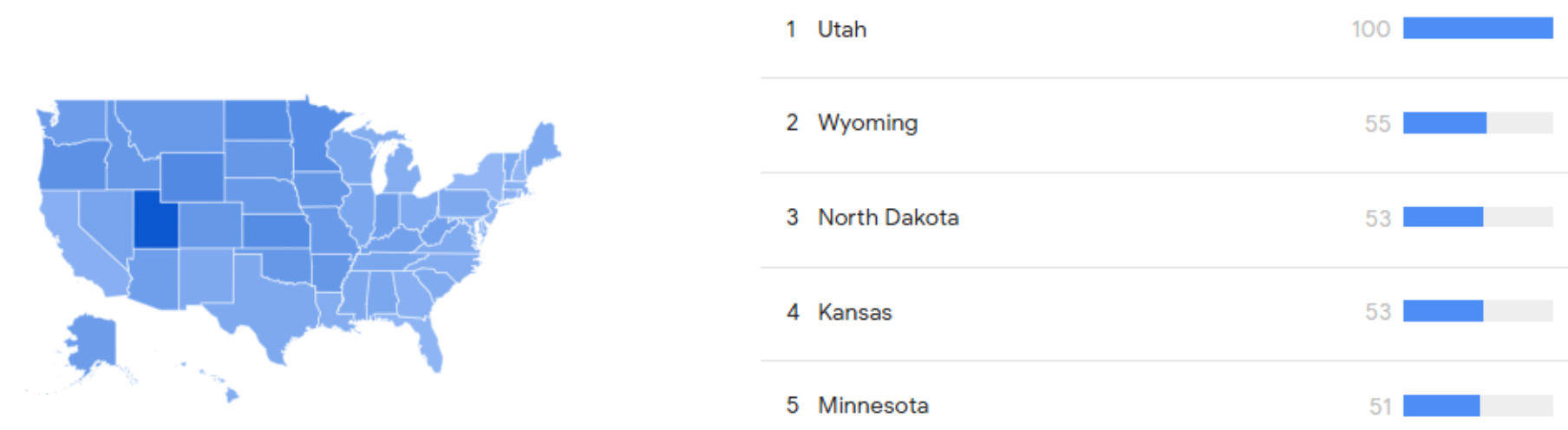

Interest by region in 2025 (Google Searches)

The original coconut-lime-cream combination is still the gold standard, but the flavor experiments have gotten pretty much unhinged. We’ve seen everything from ube-matcha dirty sodas (thanks, oat milk trend) to pickle-flavored Mountain Dew concoctions (thank you Sonic) that sound terrible but apparently taste amazing.

Of course we will also encounter tropical fruit mixes (mango, passion fruit, dragonfruit) as these are Instagram-friendly flavors that photograph well and taste like vacation. What’s more interesting is the craft cocktail influence that we can start to see here and there. Fresh basil in a berry soda? Lavender in lemonade? All serve as deliberate attempts to enhance the category beyond sugar water with cream.

Then comes the texture. Boba, gummy candies, crushed fruit, really anything that makes the drink more of an experience. Gen Zers want their beverage to be chewable; but also aesthetically pleasing, and Dirty Soda are the perfect recipe for it.

Perhaps the most intriguing development is dirty soda’s evolution into adult territory. We’re seeing versions for the fitness crowd, energy drink bases for the caffeine addicts, and yes, even cannabis-infused options. Cloud Cola’s THC dirty sodas are essentially weed cocktails for people who don’t want the hangover, a 10mg THC cola that tastes like classic cola with a mild numbing effect.

On the alcohol side, bartenders are having fun with “dirty soda cocktails” RumChata root beer being a particular favorite. It’s the perfect marriage of childlike flavors (especially in Latam) with grown-up substances, appealing to the same impulse that makes adults order cereal milk cocktails at cocktail bars.

Already in 2009, RumChata was produced by Midwest Custom Bottling Company and distributed by Agave Loco LLC in Wisconsin

|

Brand (U.S.) |

Notable Flavors & Offerings |

Functional Add-ins |

Positioning |

|

Swig (Original Dirty Soda Shop) |

Large menu of signature mixes, e.g. the “Founder” (Diet Coke + coconut + lime + cream) and the “Malibu” (Dr Pepper + coconut + vanilla). Also offers Revivers (energy drink base mixes) and seasonal flavors. |

Primarily flavor-focused (sweet add-ins and cream); offers caffeine boost via soda or energy drink, and sugar-free options, but no added vitamins/etc. |

Category originator. Trendsetter with strong social media presence. Positions as a fun, family-friendly drive-thru for customized drinks and treats. Emphasizes being “Home of the Original Dirty Soda,” using authenticity and Utah roots |

|

Sodalicious (Regional Competitor) |

Similar extensive mix-and-match menu: e.g. “AK Special” (Diet Dr Pepper + sugar-free coconut + vanilla), “Black Forest” (Dr Pepper + cherry + chocolate), etc. Famous for dozens of Torani syrup flavors (incl. unique ones like huckleberry). |

No explicit “functional” ingredients aside from caffeine in certain bases. Focuses on regular vs. “skinny” (sugar-free) versions for most drink. Fresh add-ins like mint or cream are available but no added nutraceuticals. |

Close follower/competitor to Swig. Positions as the alternative with equally broad choices, perhaps a bit more youth-oriented (edgier naming, etc.). Strong community presence in Utah/Idaho. Banks on variety (“mixology” vibe of flavor shots). Differentiator: they claim “first to do gourmet soda” in some markets, fostering local loyalty. |

|

Pepsi’s “DRIPS” (Big Brand Pop-up) |

Experimental line of dirty soda-inspired drinks under PepsiCo. Notable creations: “Starry Berry Basil” (Starry lemon-lime soda Zero + berry syrup + basil leaves) and “Dew Chill Dill” (Mountain Dew + dill pickle flavor), both showcased at 2025 NRA Show. Also featured adding popping boba, flavored creams, and fruit purees to zero-sugar Pepsi bases |

Embraces textural and dietary add-ins: popping boba for fun, fresh herbs/spices for a functional spike (basil = aroma, maybe stress relief), and mostly zero-sugar formulations (positioning as lower-calorie but fun). More about novel textures than health functions. |

Market entry by a soda giant. Positioned as bringing craft soda to mainstream, Pepsi uses DRIPS to test flavors that appeal to Gen Z and to offer restaurant clients ideas for unique non-alcoholic beverages Differentiation: leverages Pepsi’s brand sodas (e.g., exclusive Mountain Dew variants) and nationwide reach. Essentially, Pepsi is framing dirty soda as an upgrade to fountain drinks, trying to get restaurants and theaters on board by demonstrating trendy recipes. |

|

Mainstream Food Chains (e.g. Sonic, Applebee’s) |

Not a single brand, but worth noting: Sonic Drive-In introduced add-ins like real cream and various syrups to create DIY dirty sodas (branded as “Sonic Dirty Drinks” for a limited time) Applebee’s in some regions offered a non-alcoholic drink that’s essentially a dirty soda (e.g. a fizzy strawberry colada drink with cream). These are typically one or two flavors added as specialty menu items rather than a full lineup. |

Generally, these are standard sodas with dairy or syrup, no special functional ingredients beyond maybe using real fruit purée for a premium touch. Sonic, for instance, used its existing syrups (cherry, etc.) and added a splash of sweet cream (which is just dairy + sugar). So, nothing “functional,” purely indulgent. |

Defensive addition by incumbents. Positioning: “Keep customers from going elsewhere by offering the trend here.” Sonic positioned theirs as a summery indulgence, leveraging their image as the drink stop (they already sell slushes with add-ins, so it fit). Applebee’s likely positioned it as a fun alcohol-free cocktail alternative for drivers or younger guests. The differentiation here isn’t innovation but accessibility, these chains make dirty sodas available widely and conveniently, albeit without the huge variety one finds at a specialty shop. |

|

Cloud Cola (Cannabis-Infused Dirty Soda) |

Three core flavors in cans: Classic Cola, Orange Creamsicle, and Root Beer, each formulated as a creamy, sweet soda reminiscent of traditional dirty sodas. They suggest serving over ice with extras like coconut cream or lime for even more flavor. They also publish THC “dirty soda” recipes (e.g. Coconut Lime Highball using their cola + coconut cream + lime) |

Delta-9 THC (10mg) infused in each 12 oz can. This provides a cannabis “buzz”, a functional psychoactive add-in. No caffeine in their drinks (so as not to mix stimulants with THC); it’s a relaxing effect. Also alcohol-free (targeting those who want the effect without the fallout). |

Novel crossover of dirty soda and cannabis beverage. Marketed as “a nostalgic soda with a THC glow-up”. Targets adults (21+) looking for a fun, mellow alternative to cocktails – “all the bold flavor and creamy sweetness… plus a smooth cannabis buzz without the hangover”. Differentiator: being in the cannabis space, it stands out as a recreational novelty on the trend. Brand positioning centers on retro vibes (capitalizing on dirty soda nostalgia) with a modern cannabis culture angle (“stoner summer vibe” as they say). |

Now let’s be honest about what we’re looking at here. Dirty soda is still a niche within a niche, popular primarily among younger consumers and concentrated in specific geographic regions. The health implications aren’t great, these are sugar bombs with a dairy chaser. The staying power remains to be proven beyond the initial viral moment.

But here’s what makes it interesting from a business perspective: it’s created a new occasion. Dirty soda isn’t replacing anyone’s 10 AM coffee or evening cocktail. It’s carving out its own space as the 3 PM pick-me-up, the after-school sweet treat, the designated driver’s mocktail. It’s solving problems people didn’t know they had.

The fundamental challenge in dirty soda development lies in the inherent incompatibility between carbonated soft drinks (pH 2.5–3.5) and dairy components. This acidic environment creates immediate formulation hurdles that require strategic flavor system design.

The core issue is protein destabilization. When dairy meets acid, you’re managing a complex physicochemical interaction that can compromise both sensory experience and visual appeal. Your flavor system becomes the critical stabilizing factor in this equation.

The key consideration is that traditional dairy-type flavors weren’t designed for this pH range. Standard emulsion systems often fail when exposed to the acidic environment of cola bases, leading to phase separation and off-notes that can derail an otherwise solid formulation.

The market demands practical solutions that work in real-world foodservice environments. We need to deliver concentrated syrups at 60-70 Brix that maintain stability and performance over extended shelf life, because nobody wants to explain to a franchise owner why their expensive flavor system went bad after three months.

Clean label positioning is driving significant R&D investment. Natural flavor systems, recognizable ingredients, and functional additions like adaptogens or energy compounds are becoming standard requests, not premium add-ons. The challenge is integrating these components without compromising flavor delivery or system stability.

The sugar-free segment presents the most complex formulation challenge. Stevia, monk fruit, and sucralose each bring distinct sweetness profiles that don’t naturally mirror sugar’s curve. Successful systems require precise blending to match both sweetness intensity and temporal release patterns of full-sugar versions while maintaining the core flavor identity.