Color now sells flavor. In North America, natural food colors are on a tear and set to roughly double by 2030 as brands are constantly fighting to decide who has the cleanest label. Regulators and parents are squeezing synthetics (Red No.3 on the way out), but consumers still expect bright and vivid colors from their beloved comfort foods. That tension is forcing better tech: heat-stable naturals (hello, jagua blue), smarter blends (black carrot + β-carotene to keep pinks pink), and encapsulation to survive heat, light, and pH.

Social media has turned bold color into trial and velocity; pink sauces and Barbie-era launches proved it. Color also steers perception: red/pink reads sweet, green/yellow reads sour… so R&D must design palette and palate together or risk confusing the consumer. Costs and supply chains get heavier with naturals, and factories need new controls to hold shade and shelf life. The power players: Oterra, Sensient, ADM, Givaudan/Naturex, Döhler are racing to close the performance gap.

The North American food colors market has transformed into a vibrant success story. Once a sleepy corner of food additives, color is now a frontline differentiator in product innovation, and a key factor in purchasing decisions. North America’s natural food color market generated $392.6 million in 2022, and forecasts place it around $768 million by 2030. This nearly doubling of market value outpaces many traditional flavor categories. Overall food color usage (including synthetics) is rising steadily as well, an estimated 570,000+ metric tons of food colorants were consumed worldwide in 2023.

However, North America’s color story is uniquely dynamic. Unlike Europe which largely phased out artificial dyes over a decade ago, the U.S. and Canada have until recently been comfortable with synthetics in everything from cereal to soda. (Europe’s 2008 mandate of warning labels on foods containing certain synthetic dyes led to 80%+ of EU food colors now being natural, making neon cereals and candies decidedly muted across the Atlantic.) North America is now catching up fast. In 2022, the region comprised about 29.6% of the global natural colors market by revenue, and it’s projected to lead in absolute market size by the end of the decade as companies here convert legacy product lines to natural alternatives. The U.S. alone, as the region’s engine, is on track to reach $900+ million in food color sales by 2030.

In the age of Instagram and TikTok, we eat with our eyes more than ever. Vivid colors have become social currency, capable of sending a product into virality overnight. Nowhere is this more apparent than with the notorious “Pink Sauce.” In mid-2022, a Miami chef’s homemade electric-pink dipping sauce started making the rounds on TikTok. Viewers were mesmerized (and somewhat alarmed) by its insanely bright, Pepto-Bismol coloration. The buzz turned into millions of views, and Chef Pii’s $20-a-bottle “Pink Sauce” promptly sold out online. Despite controversies over its ingredients and safety, the sauce’s outrageous hue had made it an internet phenomenon. By early 2023, a partnership with a CPG manufacturer landed bottles of the once-viral Pink Sauce on Walmart shelves nationwide, proving that in the era of social media, a product’s color can be its own marketing engine.

The 2023 Barbie movie crystallized this shift. As pink dominated pop culture, food companies rushed to capitalize. Burger chains offered neon-pink buns. Coffee shops served magenta lattes. Pasta makers rolled out bubblegum-colored noodles. The strategy was transparent: tap into nostalgia and whimsy through the most attention-grabbing color possible.

If you’ve ever felt like a orange soda tasted “orange” even when blindfolded, or found a clear version of your favorite cola less satisfying, well you’re not the only one. This is because our perception of flavor is deeply intertwined with a product’s appearance. Some companies had to find out the hard way: Crystal Pepsi, the 1992 “clear cola” launched by PepsiCo with great fanfare. It was a cola that looked like plain soda water, free of caramel coloring. The taste was supposedly identical to regular Pepsi. But consumers’ brains couldn’t reconcile the flavor with the lack of brown color, many reported it “tastes like Sprite” or felt something was off.

Crystal Pepsi proved taste is more that flavor, it’s color too.

Color sets up a powerful flavor prelude. Before we ever taste a strawberry-flavored candy or beverage, the fact that it’s pink or red has already primed our brains for a sweet, fruity experience. So integral is color to flavor identity that many products are effectively defined by their shade. Candy makers like Mars and Hershey have long exploited this by tuning colors to flavors and vice versa. Skittles’ slogan “Taste the Rainbow” is a literal invitation to experience color as flavor. The color-flavor link is so strong that when Skittles once issued a special edition with all gray pieces (to honor Pride, letting the rainbow flag take precedence), many consumers reported the candy just didn’t “taste” the same without the colors, despite no recipe change. Our brains are that conditioned to eat with our eyes.

In the end, the product experience of color comes down to managing expectations. Consumers will believe what they see. A cola that isn’t brown must overcome an expectation hurdle; a strawberry yogurt with a dull beige color might be perceived as bland even if it’s tasty. This means intensifying a hue to boost perceived flavor intensity or using color cues to signal flavor combinations (e.g., a swirled red-and-yellow candy to imply a mix of cherry and lemon flavors). It’s a subtle art, part psychology, part chemistry, and when done right, the result is a harmonious flavor experience where the color tastes as it should, and the taste looks as it should.

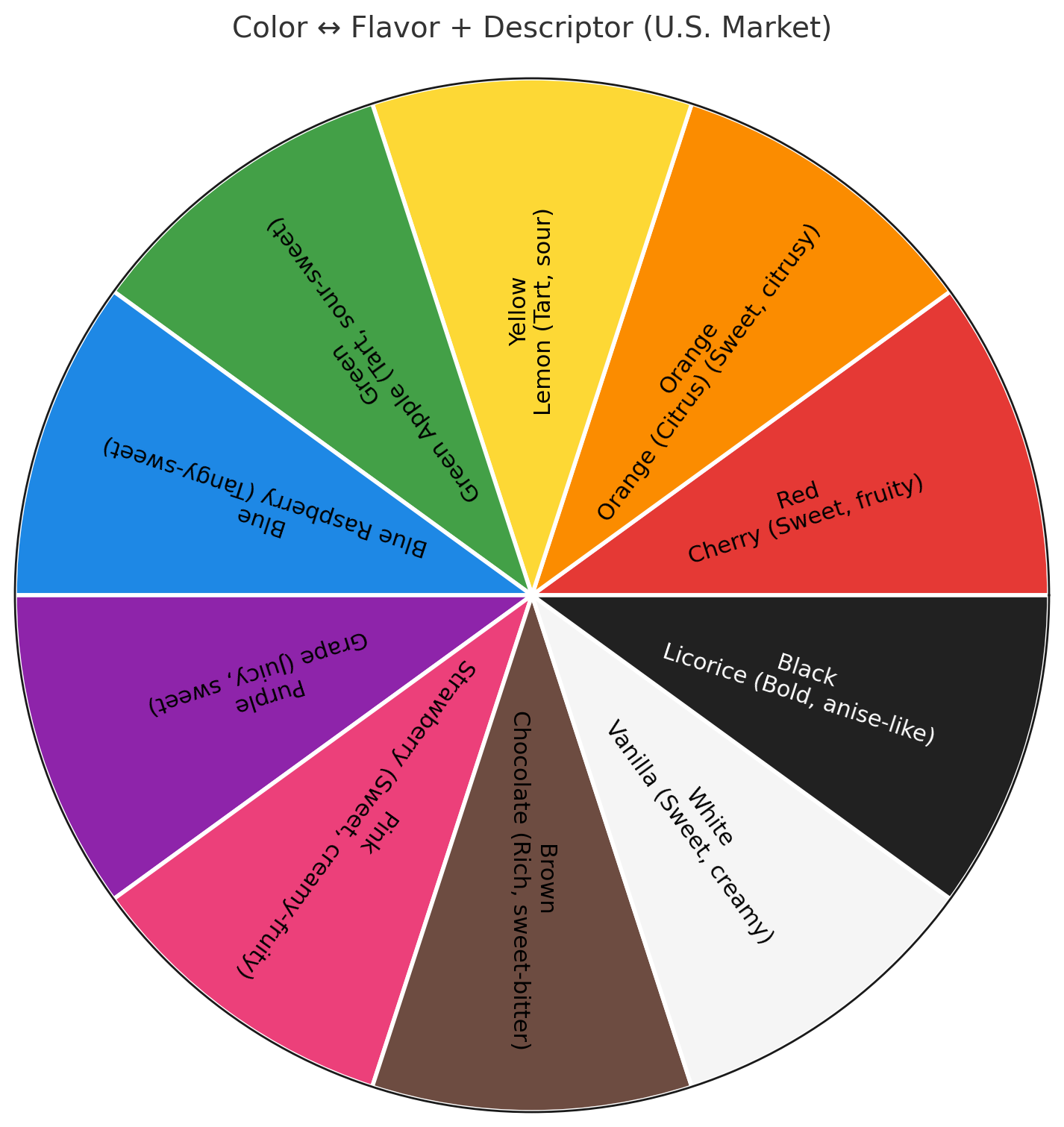

Why do so many Americans think blue raspberry is a real fruit flavor? Decades of marketing and cultural cues have trained us that certain colors are certain flavors. On one hand, these associations are a powerful tool (consumers will instantly recognize a yellow candy as likely lemon or banana-flavored); but on the other hand, they can constrain creativity (would anyone try a lemon candy that’s blue, or a chocolate bar dyed green?). This chromatic conundrum is a key consideration in flavor analysis and development today.

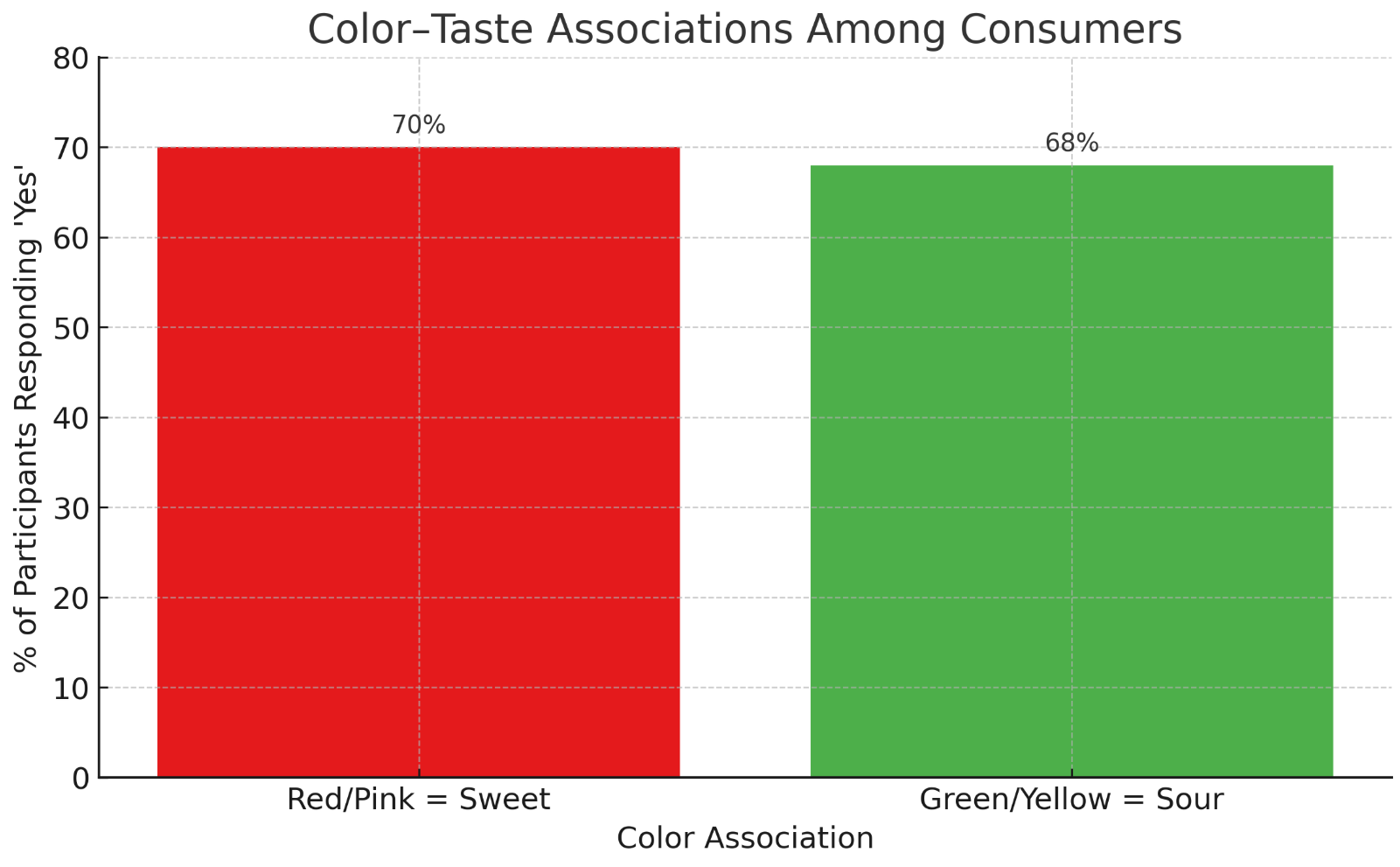

A recent 2025 mixed-reality experiment demonstrated that participants overwhelmingly associated red and pink colors with “sweet” tastes (about 70% of respondents) and green or yellow with “sour” tastes (about 68% of respondents). Over generations, we’ve internalized these truths: color signals flavor. Even shape plays a role (rounded forms suggest sweetness, angular forms hint at bitterness or sourness), but color is the most immediately processed visual cue in a food or beverage.

In summary, understanding and mastering color–flavor interplay is now a core part of product development. Flavor scientists must ask not just “How does it taste?” but also “Does the color align with the taste?” and “What emotions or expectations will this color trigger?” The crux of the flavor-color puzzle is finding the sweet spot where color delights and guides the palate without confounding it, as consumers learn that yes, a blueberry latte can be lavender-colored, or a bright yellow curry can taste of lemon and chili. The palette of flavor is widening, and with it, so is our palate.

Now, can those wild and electric hues consumers love also check the “natural” and healthy box? In North America, we are witnessing a regulatory and consumer-driven reckoning with artificial dyes that is forcing this issue. California’s recent legislation banning Red No.3 in foods (along with several other dyes in school cafeterias) sent a strong signal . New York, Illinois, and other states have floated similar bans or warning label requirements. And as of 2024, the U.S. FDA has moved to de-list Red No.3 by 2027, effectively phasing out a dye long used in candies and sprinkles.

Cultural differences also play a role. In Asia, for example, a pale green might be associated with melon flavor (honeydew or muskmelon) far more than in North America. In Japan, a popular grape flavor is a light green “Muscat” grape, unlike the deep purple “Concord grape” flavor common in the West.

Color signals flavor differently across cultures.

Surveys show that a majority of Americans distrust artificial colors (78% express at least some concern about ingesting them). A 2024 study by NATCOL (the natural colors industry association) found US consumers overwhelmingly associate the term “natural color” with positive attributes like “safe,” “healthy,” and “quality”. It’s now common to see front-of-pack badges proudly proclaiming “colored with real fruit juice” or “no synthetic dyes”.

However for manufacturers, simply swapping artificial dyes for natural ones is rarely simple.

Natural colorants can require different handling and introduce new hurdles in production. For one, they are often less intense, meaning higher usage levels are needed. It’s not unusual to need 4 to 12 times more natural pigment to achieve the same shade strength as a synthetic color. This has a domino effect: higher volume of colorant can affect taste (as discussed), and it certainly affects cost. Natural colors are significantly more expensive per unit than petrochemical dyes. Plus, many natural colors are liquids or suspensions rather than easy-to-mix powders, which complicates manufacturing.

Ironically, the same consumers demanding natural colors also expect the vibrant visuals they’re used to. This has led to some friction.

The gap is closing, natural color technology has improved, but companies tread carefully to avoid what one might call the “natural but not enjoyable” feeling. Notably, European consumers have adjusted their expectations (e.g., European Froot Loops are indeed muted in color compared to the American version). In North America, we’re in a transitional phase of that adjustment. Brands are being upfront via packaging, preparing consumers for slightly different appearances, and emphasizing the trade-off: this product might look a bit different, but it’s made with natural colors and is better for you. In many cases, especially for shoppers used to reading labels, that’s a compelling pitch.

Developing a stable, natural color for a food or beverage is a bit like taming a wild rainbow. The core challenges are well-known in the color science community: sensitivity to pH, heat, light, and oxidation. Take anthocyanins, the red, purple, and blue compounds from berries and purple veggies. They’re brilliant at low pH (hence their great use in acidic beverages like a bright red soda or pink lemonade). But put anthocyanins in a neutral pH dairy base (like a yogurt or milkshake) and watch the color shift to an unappetizing bluish-grey. In the case of , this was exactly the problem when trying to remove Red 40: the natural red from berries kept turning bluish-purple in the milky base. Oterra scientists solved it by blending a bit of β-carotene (orange) with a stable red anthocyanin from black carrot to counteract the color shift. The result is a pleasing pink that stayed pink.

Blue spirulina (phycocyanin) has given us a beautiful natural blue in recent years, opening doors to Smurf-blue smoothies and confections. But it’s extremely heat-sensitive. In fact, when exposed to high temperatures, spirulina’s blue not only fades, it can precipitate or break down entirely. This means no baked goods or hot candies with spirulina… unless you can protect it. That’s where techniques like microencapsulation come in. By encapsulating sensitive pigments in a protective matrix (say, a mix of dextrins or gums), you can shield them from heat and light. As of 2023, over 60 manufacturers have adopted microencapsulation technologies to bolster natural color stability in everything from neon fruit snacks to brightly colored sodas

Blue spirulina brings beautiful color, if you can keep it stable.

Naturals also can have slight batch variability (a harvest of paprika with more carotenoids yields a stronger orange than a weaker harvest, etc.), whereas FD&C dyes are identical every time. So the mission in R&D is twofold: keep closing the stability/performance gap, and do it efficiently. Many in the industry are optimistic. As one color scientist put it, “Five years ago, no one believed we could have a natural blue M&M that didn’t bleed or fade, now we’re basically there.”

|

Company |

Notable Focus & Strengths |

Positioning & Key Moves |

|

Oterra (Denmark) |

100% Natural Colors, broad pigment portfolio (ex-Chr. Hansen). Expertise in agronomy & biotech for color. |

Recently achieved FDA approval for jagua blue, unlocking natural blue applications. |

|

Sensient (USA) |

Full-spectrum Colors. from certified dyes to plant extracts. Strong R&D in stabilization (encapsulation, emulsions). Vertical farming of key botanicals. |

CEO calls regulatory shift “biggest opportunity” Aggressive in capturing market share from dye phase-outs. |

|

ADM (USA) |

Colors from Nature™ line, focuses on beverage and food colors via fruit/vegetable concentrates. Integrates flavor & color for holistic solutions. |

Leveraging global agri-supply (e.g., growing acres of paprika, spirulina). Positioned as cost-effective natural color partner for multinationals. |

|

Givaudan/Naturex (Switz.) |

Plant-based Colors, high-purity extracts and “food label” coloring ingredients. Synergy with Givaudan flavors & ingredients. |

One-stop shop for flavor + color innovation. Helping reformulate candies, beverages with natural hues globally. Invested in fermentation startups for novel colors. |

|

Döhler Group (Germany) |

Integrated Natural Ingredients, offers coloring foodstuffs and concentrates (often contributing taste & nutrition too). Strong in beverages, dairy, confectionery applications. |

Advocates for clean label coloring. Growing presence in US as EU model of coloring foods catches on. Pioneered use of blends (e.g., carrot + pumpkin for warm orange) to replace synthetic sunset yellow in orange sodas across Europe. |

We can also expect to see more patent activity from these players, as they develop proprietary methods to produce or stabilize colors. They operate at the intersection of nature and science, each vying to produce the brightest, most stable, and consumer-friendly colors. And while they compete, their collective efforts are enabling the food industry to enter a new era: one where food can be colorful, natural, and delicious all at once.