Since the dawn of humanity, we’ve tried to stretch our years with whatever tools we had… herbs, rituals, diets, supplements. Longevity was always the endgame. Although longevity flavors do sound like a sequel to functional flavors, they are the new baseline in US food and beverage. Energy, immunity, cognition, gut health, cellular support, consumers now want it all. Over 80% of Americans already consume wellness drinks, but 9 in 10 still demand strong flavor first. The takeaway for developers: no one buys bitter twice, so here success means balancing a useful function with a good taste.

The grocery aisle is now turning into a CVS. It promises sharper focus, immunity boosts, stress relief. 83% of Americans reach for functional beverages at least sometimes, with 75% naming cognitive health as their driver. Boomers gravitate toward collagen waters; Gen Z toward kombucha and adaptogen lattes. The Blue Zones myth has gone mainstream. Longevity is no longer a myth, it’s a reason for what ends up in suburban shopping carts.

“Longevity flavors” mark a shift in how food and drink are built. Flavor stops being garnish and becomes part of the health equation. This market rests on connected pillars that define a new way of designing products.

1. Proactive Flavor Science

Here, flavor systems double as delivery tools for bioactives. Polyphenols and flavonoids, mostly found in berries, grapes, and tea, are linked to lower chronic disease risk and longer life. Resveratrol and curcumin go further, activating sirtuins and supporting mitochondrial function in ways that echo calorie restriction. Folding these compounds into formulations moves flavor from a passive backdrop to a functional ingredient.

2. Compensatory Flavor Design

Aging dulls the senses. Taste buds weaken, smell fades, and meals can feel flat. The fix is bolder flavor work. Developers turn to umami-heavy tools, mushroom extracts, yeast compounds, to restore depth without cranking up sugar or sodium. The goal isn’t indulgence for its own sake but preserving appetite and satisfaction, which in turn helps prevent malnutrition in older consumers.

Umami keeps meals satisfying, even when taste fades.

3. The Flavor of Absence

One of the strongest signals in the longevity market isn’t what’s added, it’s what’s missing. “Clean label” is now a baseline, pushed further by data linking certain additives to higher mortality risk. A UK Biobank study tied flavor enhancers and artificial sweeteners in ultra-processed foods to poorer outcomes, and consumers took notice.

That’s why brands now sell absence as much as presence. No artificial flavors. No synthetic boosters. Just a reassurance that what’s in the bottle won’t work against your health goals.

Perennial’s plant-based drinks for adults over 50. They skip the additives and lean into natural flavor cues tied to gut, bone, and brain health. It’s not a loud or exotic profile, but one that signals wellness through restraint, a clean, plant-first taste that fits the long game of healthy aging.

4. Don’t Die: The Man Who Wants to Live Forever

Bryan Johnson’s much-mocked “Blueprint” mix is a slurry of greens, nuts, cocoa flavanols, collagen, and creatine, engineered for cell resilience, not taste. The profile is bitter and earthy, barely lifted by cacao and berry. Without strong flavor cues, products like this would stay niche, because most people won’t buy something that tastes unpleasant twice. That’s why they are steering toward options like blood orange and pineapple yuzu: flavors that make the function drinkable, even desirable.

These profiles carry their own longevity halo, citrus polyphenols, vitamin C, digestive support, but they do it with bright, refreshing flavor cues consumers actually want.

Longevity flavors don’t form a market on their own. They sit at the core of the wider functional food, beverage, and nutraceutical sectors in North America, industries now shifting from niche adoption to mass scale.

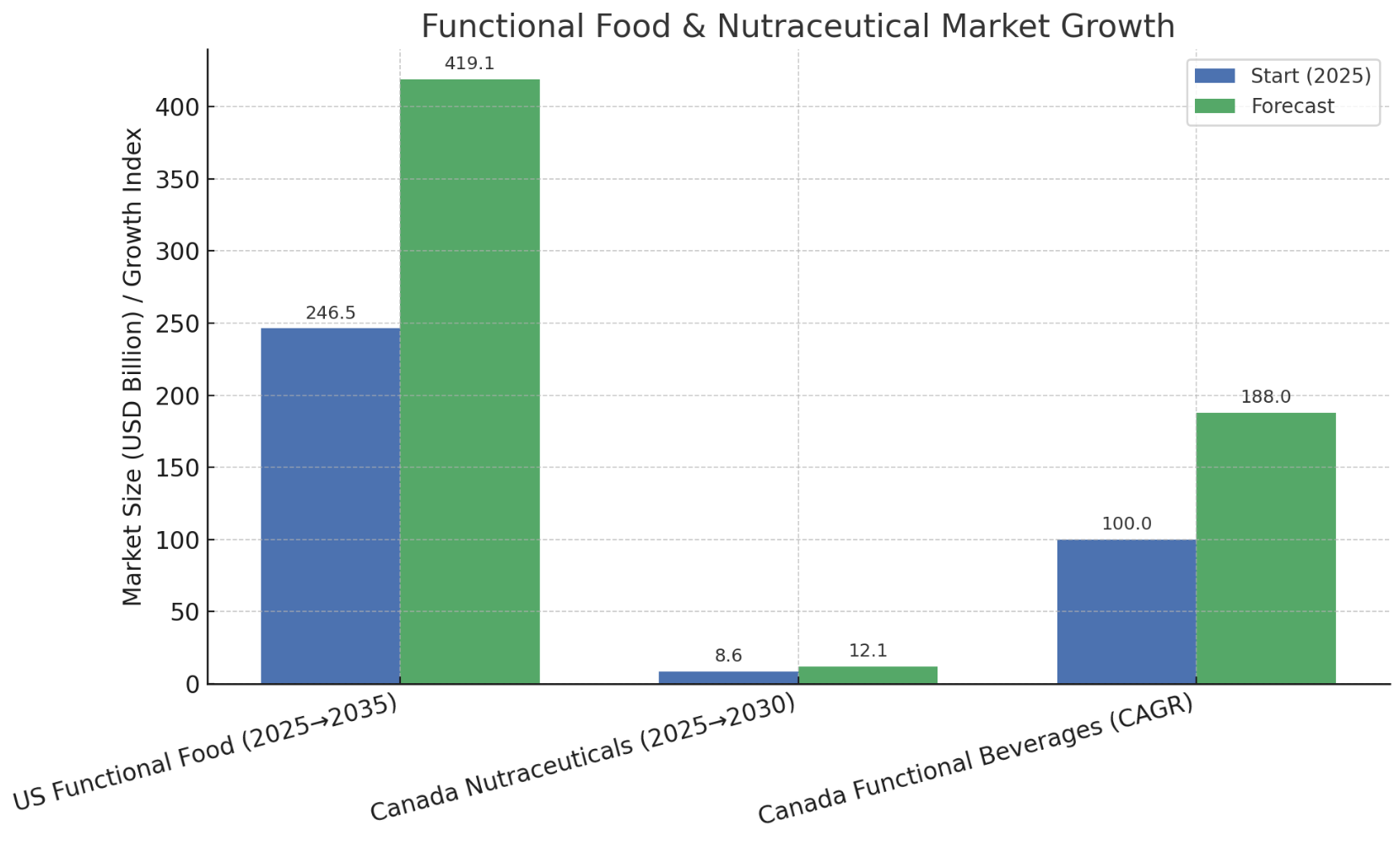

The money is big. The US functional food market is set at USD 246.5 billion in 2025, with forecasts hitting USD 419.1 billion by 2035 (5.5% CAGR). Canada’s nutraceuticals market follows the same curve: USD 8.63 billion in 2025, climbing to USD 12.05 billion by 2030 (6.9% CAGR). Functional beverages stand out as Canada’s fastest mover, growing 8.8% a year through the decade.

Why the surge? Consumers are chasing nutrient-enriched diets and preventative health, with hectic lives pushing them toward solutions that promise resilience and energy. The global wellness economy, USD 1.8 trillion, is now leaning on products that can show real, science-backed impact. On the supply side, AI-driven ingredient discovery and delivery systems like liposomal encapsulation are speeding up both R&D and market adoption.

But the make-or-break point is taste. Bioactives often come with bitterness, earthiness, or metallic tails that turn daily use into a chore. Without flavor tech, no functional product scales. Masking, balancing, and stabilizing those compounds is what makes the category consumable. Longevity flavors, then, aren’t a side story but rather the enabler that lets the entire multi-billion-dollar functional industry run.

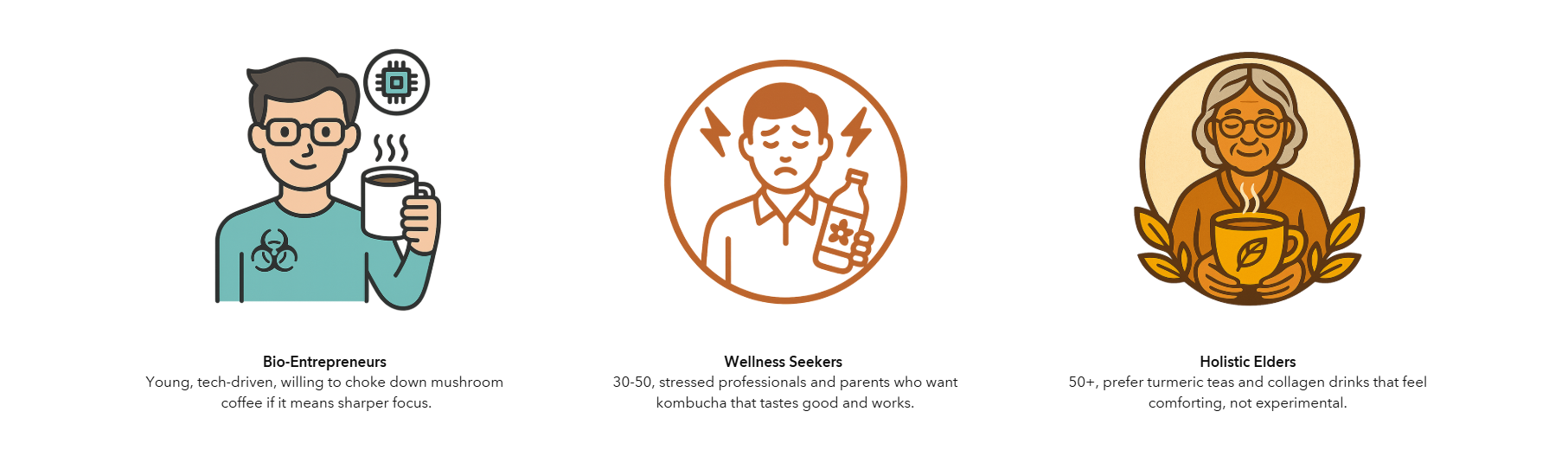

The North American longevity market is a patchwork of people with very different bodies, priorities, and reasons for buying. If you want to make products that land, you need to start with that reality.

The biology matters. As people get older, taste and smell fade, often dulled further by medications or health conditions. Food can feel flat, which means bolder, more layered flavor profiles aren’t just creative choices but functional ones.

Taken together, the market divides into three broad groups, each with its own mix of physiology and motivation.

But don’t picture this market as a nursing home dining hall. The real momentum comes from the younger side. Gen Z and millennials are adopting wellness tools earlier, with the goal not of rolling back age, but of protecting their future “health span.” They’re shopping for benefits they can feel now, sharper focus, more energy, smoother digestion, while hedging against the risks they’ll face later.

That attitude shows up in the products they pick. Functional drinks, supplements woven into social rituals, and the rise of “preventive indulgence” are all signals of this shift.

Ruby Artemisia and Black Ginger fold adaptogens into a profile that’s more aperitivo than wellness shot.

Flavor signals vitality, and the side effect happens to be support for gut, skin, and metabolism.

A powder that turns your water into a daily ritual.

B-vitamins ride on a light, refreshing berry flavor, proof that longevity doesn’t need to taste medicinal.

Longevity flavors don’t come from marketing (at least not completely). They come from science. Researchers have mapped the bioactive compounds in plants that keep cells resilient and slow the grind of age. That connection between diet and vitality is the backbone of this market.

Polyphenols are the headline act. These antioxidants shield cells from oxidative stress, the slow burn of aging and environment. Among them, flavonoids carry the strongest evidence. A Nature Food study linked a varied, flavonoid-rich diet (tea, berries, apples) to a 16% drop in all-cause mortality and lower risks of heart disease and type 2 diabetes. The takeaway: eat the rainbow, don’t bet on a single source.

Other compounds worth knowing:

Resveratrol (red wine, grapes, blueberries): flips on SIRT1, mimicking calorie restriction and boosting mitochondrial resilience.

Quercetin (apples, berries): kicks AMPK into gear, driving cellular cleanup (autophagy) and energy regulation.

Curcumin (turmeric): a double activator of SIRT1 and AMPK, while also damping inflammation.

EGCG (green tea): another SIRT1/AMPK player tied to better metabolic health.

Oleuropein (olive oil): reinforces antioxidant defenses and cardiovascular support via the same pathways.

SIRT1: A protein that helps regulate aging and stress response.

AMPK: An enzyme often called the body’s “energy sensor.”

Most of these molecules taste awful. Bitter, earthy, sometimes outright unpleasant. If a product can’t be enjoyed, it won’t be consumed long enough to deliver any benefit. That’s why flavor houses play such a central role. They use masking systems to strip away off-notes, layer in appealing profiles, and even add natural antioxidants to stabilize delicate compounds. The science doesn’t work without the flavor tech, function and pleasure have to be engineered together.

In the North American longevity space, regulation acts as both safeguard and signal. For companies willing to treat it as strategy, it becomes a path to credibility.

In the US, the FDA oversees flavors through the 1958 Food Additives Amendment. Substances are either GRAS (Generally Recognized as Safe) or food additives that require formal approval. GRAS status comes from FEMA expert panels and demands evidence on par with a full additive petition. Even label claims like “antioxidant” need to tie back to a defined RDI and proven biological effect.

Canada’s framework rests on clarity and proof. All claims must be true, verifiable, and precise. Non-therapeutic claims can pass, but therapeutic ones, such as “eliminates age spots”, are reserved for regulated health products supported by data.

Longevity flavors are the reason functional foods can leave the lab and end up in your cart.

The science may promise resilience, but flavor is what makes people come back.

thank you for reading!

Sources