While everyone has been chasing artisanal everything, freeze-dried candy quietly conquered the world. We are now approaching $1.5 billion in worldwide sales, heading to $2.4 billion by 2030. This is quite the avalanche for what’s essentially the confectionery version of beef jerky.

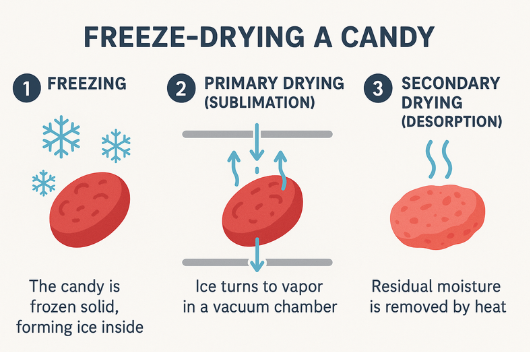

The process is beautiful: sublimation strips moisture while preserving flavor and structure. Take a strawberry, freeze-dry it, and you get an ethereal, crunchy ghost that explodes on your tongue. It’s nature’s Pop Rocks without the chemistry.

Sure, the typical candy flavors dominate, berries, apples, bananas. But dragon fruit is showing up, as well as other more premium flavors such as lychee or passionfruit.

But where it gets interesting is that this is more than empty calories in a fancy packaging. Freeze-drying actually preserves nutrition better than traditional candy manufacturing. It’s portable, shelf-stable, and achieves a “clean label” positioning without sacrificing taste.

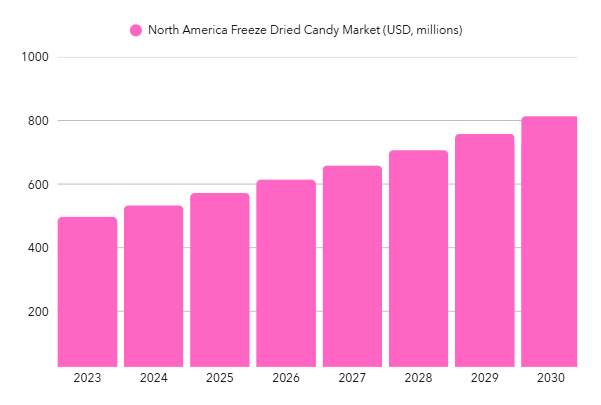

The North American freeze-dried candy market breathes with a $497M exhale in 2023, expanding toward $813M by 2030. This is a 7.3% CAGR that maps consumer hunger for a textural disruption in the candy market. This isn’t novelty, but a sensory archaeology where familiar fruit profiles (strawberry, banana, apple) anchor the largest segment while premium/artisanal players start to include more exotic profiles.

Brick-and-mortar retail maintains its 36% stronghold as the great democratizer, yet e-commerce surges at 11.5% CAGR, transforming impulse into algorithm. Each purchase reflects a pursuit of pure flavor and sensory explosion. While candy while most likely remain an impulsive purchase at the checkout, growing online sales tell a different story…

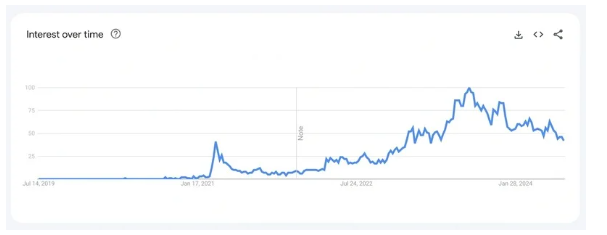

Consumer search behavior for “freeze-dried candy” have been pretty hectic recently. Surging in 2022, followed by a steady growth as Gen Z discovers the potential of sublimated sweetness through viral TikTok demonstrations.

The analytics tell a familiar story: explosive interest in 2021, then inevitable decline, then resurrection as major brands legitimized what began as novelty. These “massive spikes” in search volume are digital breadcrumbs marking the transformation from fad to an established niche.

The sustained uptick implies freeze-dried candy has transcended mere novelty and has become a textural language that speaks to consumers hungry for sensory disruption, though long-term survival depends on the industry’s ability to keep feeding that curiosity with new flavors, applications, and clean-label positioning that transforms impulse into habit.

The freeze-dried candy landscape organizes itself around texture: fruit pieces (strawberries, blueberries), and iconic candies: Skittles, Starburst, gummy bears… transformed from chewy candies into crystalline shards that dissolve like sweet snow.

Sow Good Inc. leads this revolution with their “fewer bites” philosophy, where they take a well-known candy and create its counterpart freeze-dried version. On the other hand, while Hershey’s 2025 Jolly Rancher launch signals corporate legitimacy. The format’s genius lies in its contradictions: airy yet intense, ancient preservation technique and novelty altogether.

Sublimation doesn’t just remove moisture but it also concentrates flavor into something more potent than the original, creating shelf-stable artifacts that taste like it’s supposed to, whether on the bench or on the shelves. Clean-label positioning and premium pouches complete the transformation to sophisticated snack, each resealable package (see above) promising a burst of untouched flavor and aroma.

The freeze-dried candy industry is fragmented into two flavor territories: the familiar and the aspirational. On one hand we find the core flavors that have been around for centuries; strawberry, raspberry, citrus, the trinity of grape-apple-cherry, they all used to be a part of every childhood, blue raspberry Jolly Ranchers, all transformed into crystalline textures.

But the true margins are those found in more exotic batches: dragon fruit’s, lychee’s, passion fruit’s…

Brands are chasing sophistication from exotic profiles to savory provocations (chamoy-covered) that challenge the very definition of candy. Each flavor profile becomes a small opportunity to demonstrate its full sensory potential, with the sublimation concentrating taste and cultural aspirations.

Freeze-dried candies feel lighter, tastier and in some cases, they are very similar to a fruit snack. That’s especially true when the ingredients are simple. Some freeze-dried options are literally just fruit. No added sugar, no preservatives, no artificial colorants. It’s crisp because of the freeze-drying, not because of additives. And that process alone, by removing moisture and preserving structure and shelf life, allows brands to skip the usual chemical stabilizers. In a climate where more and more consumers rely on the label to make a decision (myself included), this is precious for clean-label shoppers who want snacks they can recognize and pronounce.

But let’s not confuse processing with purity. Most freeze-dried candies are still made from the original confections, meaning full sugar, artificial colors & flavors. Freeze-drying doesn’t rewrite the label at all, it just changes the texture. A freeze-dried Jolly Rancher still has the same ingredients as its chewy counterpart. Same goes for Skittles, Laffy Taffy, Nerds.

Once dried, candies are extremely hygroscopic. Products must be protected from moisture and oxygen to preserve crispness. Air-tight, light-resistant packaging (e.g. Mylar pouches, foil-laminated bags) is required. Many producers use resealable zip-lock pouches with oxygen absorbers or nitrogen flushing. Without proper packaging, freeze-dried candy will reabsorb humidity, become chewy, and lose quality.

In ideal dry, cool storage, freeze-dried candy can last for years (often 5-10+ years). (One source notes freeze-dried foods can last 25+ years under perfect conditions). However, candy sugars can still crystallize or stale eventually; labeling and rotation are strongly recommended.

The freeze-drying process retains most of the original candy’s nutrients and sugars (i.e. caloric content is largely unchanged). It does, however, eliminate moisture, making the product lighter and lower in weight/volume. Manufacturers tout any fruit or vitamin content (from fruit-based candies) as a benefit, but standard candies remain high-sugar.

|

Brand |

Flavors |

Positioning |

|

Mars/Wrigley (US) |

Skittles (official freeze-dried line), Original and Sour |

One of the first mainstream candy giants to offer in-house freeze-dried candy under a flagship brand. Plays on novelty and authenticity. |

|

Sow Good (US) |

Classic candy varieties (Skittles, Laffy Taffy, Bears, in both sweet and sour versions) in a freeze-dried version. Recent formulation/flavor changes suggest that they now produce their own in-house candies. |

Specialty novelty candy focused on “hyper-dried, hyper-crunchy” treats. Emphasizes big flavor in fewer bites; targets social-media savvy youth. |

|

Hershey (US) |

Jolly Rancher hard-candy flavors (grape, watermelon, apple, cherry) |

Major confectioner leveraging its Jolly Rancher brand. Marketed as “shockingly crunchy” fruity candy, aimed at mainstream customers and novelty seekers alike. |

|

SpaceSweets (UK) |

Various UK favorites (e.g. refried cola bottles, sherbet limes, marshmallows) |

Europe’s largest freeze-dried sweets retailer. Offers an extensive range of freeze-dried candies (including imported American candies) at competitive prices. Positioning is broad-appeal, capitalizing on variety and value. |